Hi friends,

Pow pow 🥊 Oppa!

Welcome back to the second edition of the NewWealth newsletter where every Tuesday, I share my best learnings on business, finance, Bitcoin, and other cryptocurrencies.

Why New Wealth? Because going through school, I realise how little does it really set us up for success. This is the business and life education my friends and I wish we had when we were younger!

I use to be impressed by people who has a lot of money or run a big company. Now I’m really impressed by people who has a lot of free time.

Wealth can mean very different things for everyone. For me, health, love, time is the ultimate measure of wealth. It’s the new wealth that isn’t talked about, and while you don’t need to have a lot of money to achieve those, having money helps makes it a lot easier.

Now I want to thank all of you this week because I just hit 200 subscribers in less than 7 days! This has definitely been the highlight of my week and energised me to keep sharing amazing content with you all! I’ve also gotten tons of replies and comments. I’m loving the questions and comments from each and every one of you.

If you love this, please keep sharing it. Let’s create a community together!

This week, we’re going to cover:

Introduction on NFT

OpenSea and NFT soar to the moon

NFTs’ future possibilities

Now, it’s a slightly longer post because I’ve included more pictures 📸. If you’re on Gmail, I’d recommend you opening up the post here to read to avoid having the post being cropped out.

Let’s gooo!

An intro to NFT

NFT is like the new Bitcoin in 2017. If you haven’t heard of NFT, you’ve probably been living under a rock from the internet! And I don’t blame you… it’s a jungle out there. But that’s why you’re here 😉.

A quick overview for the uninitiated!

NFT stands for non-fungible token. What the heck does non-fungible means? I never learnt this word at school!

In economics, fungibility is a characteristic where each unit of a good is interchangeable and indistinguishable from the other.

That’s a mouthful.

Simply put fungible means you can swap two things and it wouldn’t matter because the value of them is the same. Our good old USD is a good example of something that is fungible.

If you have a $10 banknote, and your friend, Katy, has a $10 banknote, you can exchange notes with each other and they would be valued as the same thing.

However, in the case of Katy’s favourite, limited edition Pokemon Card, it is a totally different, non-fungible, story.

If you’ve ever played Pokemon growing up as I did, you’ll know that the shiny Charizard card has a heck of a lot more value than a regular Pikachu. Even if you have the same shiny Charizard card, because each has a different year of production, print edition and, preserved quality; it makes each card unique, and the value different.

Fun fact, the 1999, first edition Charizard was recently sold, 20-plus years later, for $369,000 USD. What gives the card its high price tag? Supply and demand my friends.

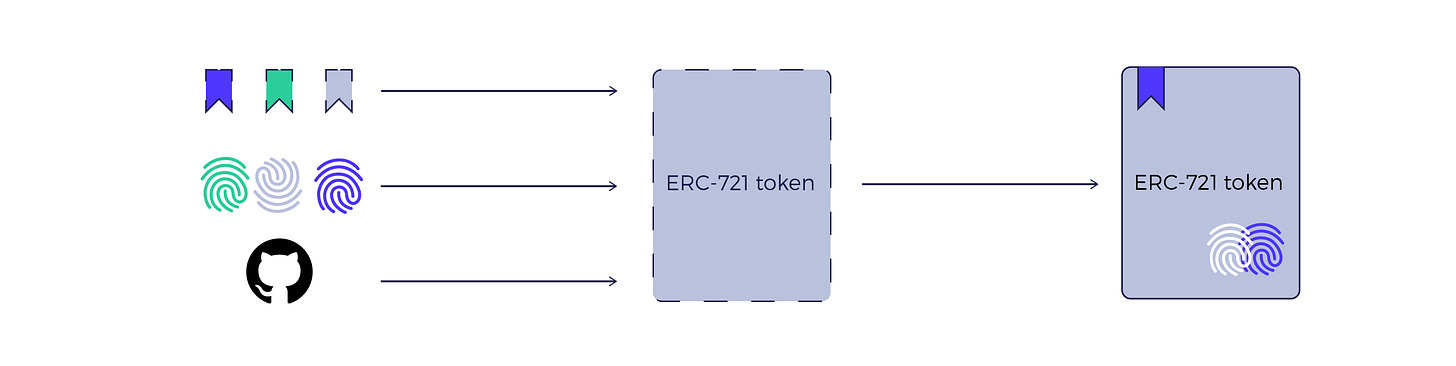

For any geeks like me and engineers who want to flex their technical background a little 🤓 - the improvement updates, ERC-721, and ERC-1155 on the Ethereum blockchain in 2018, allows developers to create contracts that create distinguishable tokens with different properties as well as create rules on how both these fungible (i.e. in-game gold, arrows) and non-fungible tokens (i.e. swords, shields) behave.

In other simpler words, it allows developers to programmatically generate 10,000 bored-looking apes in JPEG with different properties like background, eyes, mouth, clothes, earrings, etc and make it unique - and sell it for, as of today just over half a billion dollars!

We are literally printing JPEG and turning it into money! 🤯 🤑

Besides Ethereum, many other blockchains have also started offering developers the ability to create NFTs.

Non-fungibility actual exists all around us. This concept extends to:

Concert tickets;

Real estates;

Unique artworks, historic artifacts;

High-end watches, handbags;

Unique IPs, celebrity signatures;

And my favourite, Fornite dance and skins!

While right now, it mostly applies to digital art. How this technology will disrupt how we prove, track, and monetise scares, non-fungible assets in the world, is up for anyone to dream and innovate on!

Did you know someone who’d love to know more about NFT? Share this with them!

OpenSea and NFT soars to the moon

How hot is NFT getting right now?

Well, let’s take a look.

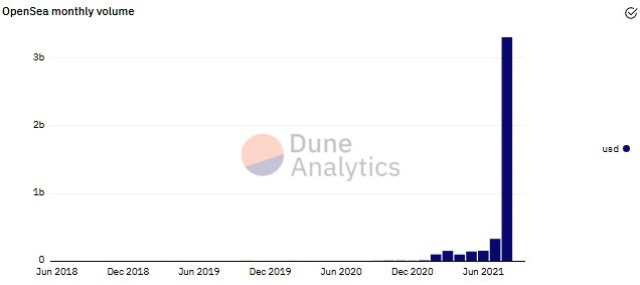

OpenSea, a peer to peer NFT marketplace that has seen explosive growth in the last 8 months. Transactions have soared from $8 million dollars in January 2021 to $3 billion dollars in August 2021 - absolutely nuts!

OpenSea takes a 2.5% fee for each transaction that happens on the platform, helping the platform grow along with the NFT ecosystem.

I think when you see a new industry being created, one of the best ways to invest is to simply invest in infrastructure that benefits from the overall market growth, regardless of what the individual products, websites, etc end up doing. Building a marketplace is a great way to do that.

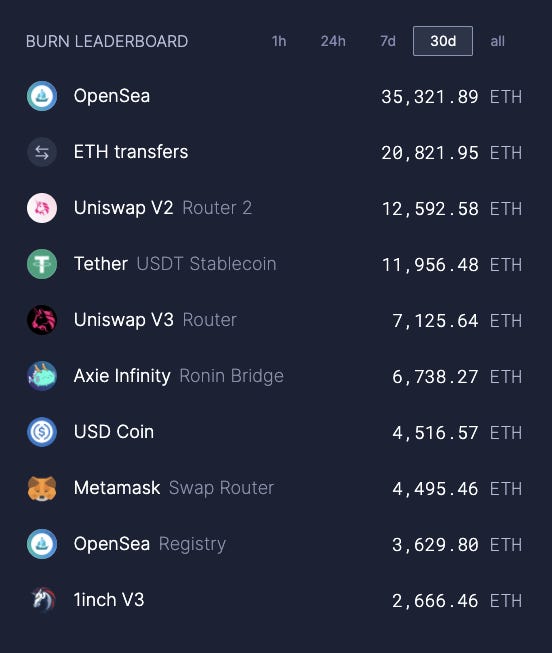

Another great way to do that is to invest in the underlying blockchain that these NFTs are built and transact on. Currently, the majority of it is on Ethereum.

In fact, we can take this a step further and estimate by looking at the number of ETH burned by use case as a proxy of which use case drives most of the ETH use case in the last 30 days - currently, OpenSea is driving the highest number of transactions on Ethereum, beating the transfer of ETH itself, as well as decentralised exchanges and stable coins!

This is the beauty of an open, transparent system. You can see, everything and stay informed!

Now, putting all the crypto aside, let’s take a look OpenSea purely as a marketplace company, let ya boy share some thoughts on it. I’ve built and worked in an IPOed marketplace company after all 🤓!

OpenSea was only founded 4 years ago in 2017. It’s not that old! In July, they raised a $100M dollars round with a valuation of $1.5Bn dollars.

In 2018, they did $437k in transactions.

In 2019, they did $8 million.

In 2020, they did $24 million.

And they just did more than $3 billion already, in the month of August 2021.

You literally cannot see the sales volume on Aug 2018 all the way to Dec 2020 👀 because the sales in August 2021 is so absurdly high.

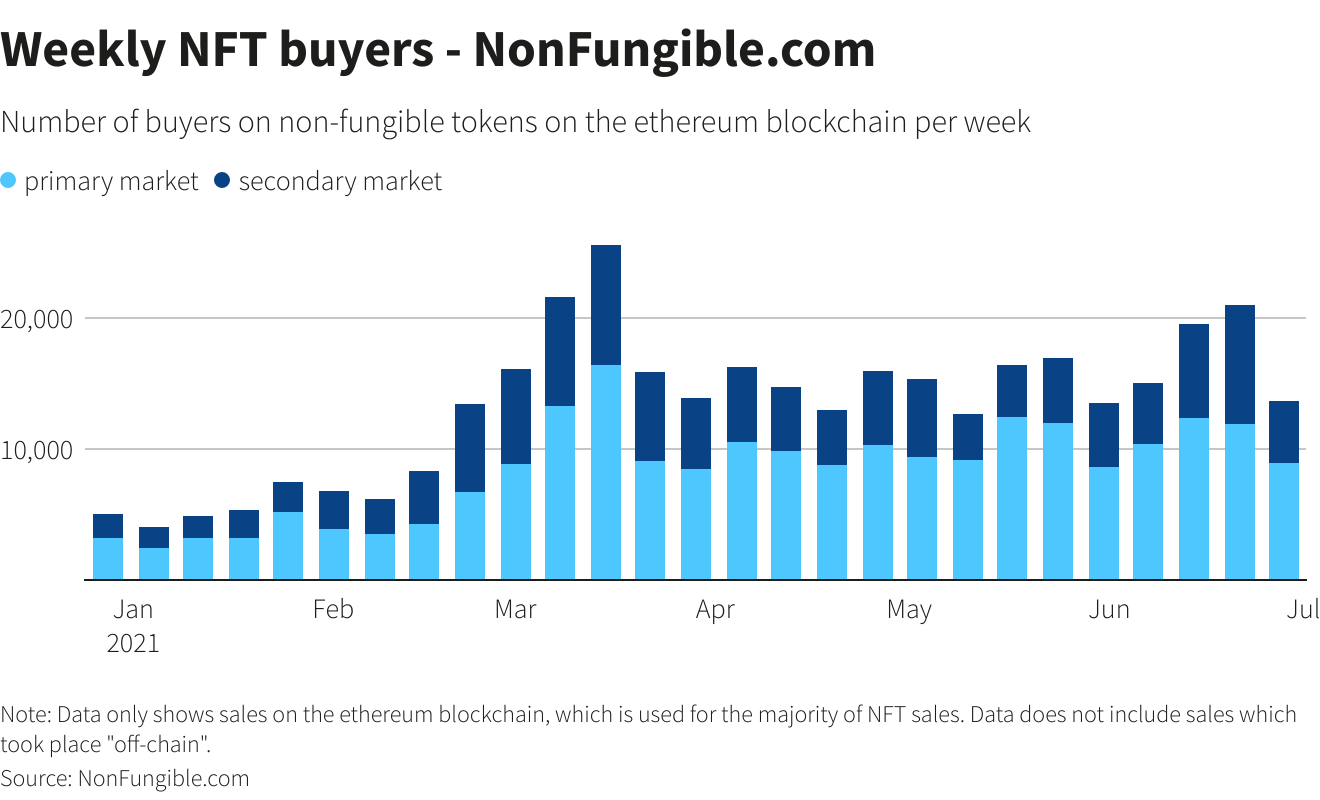

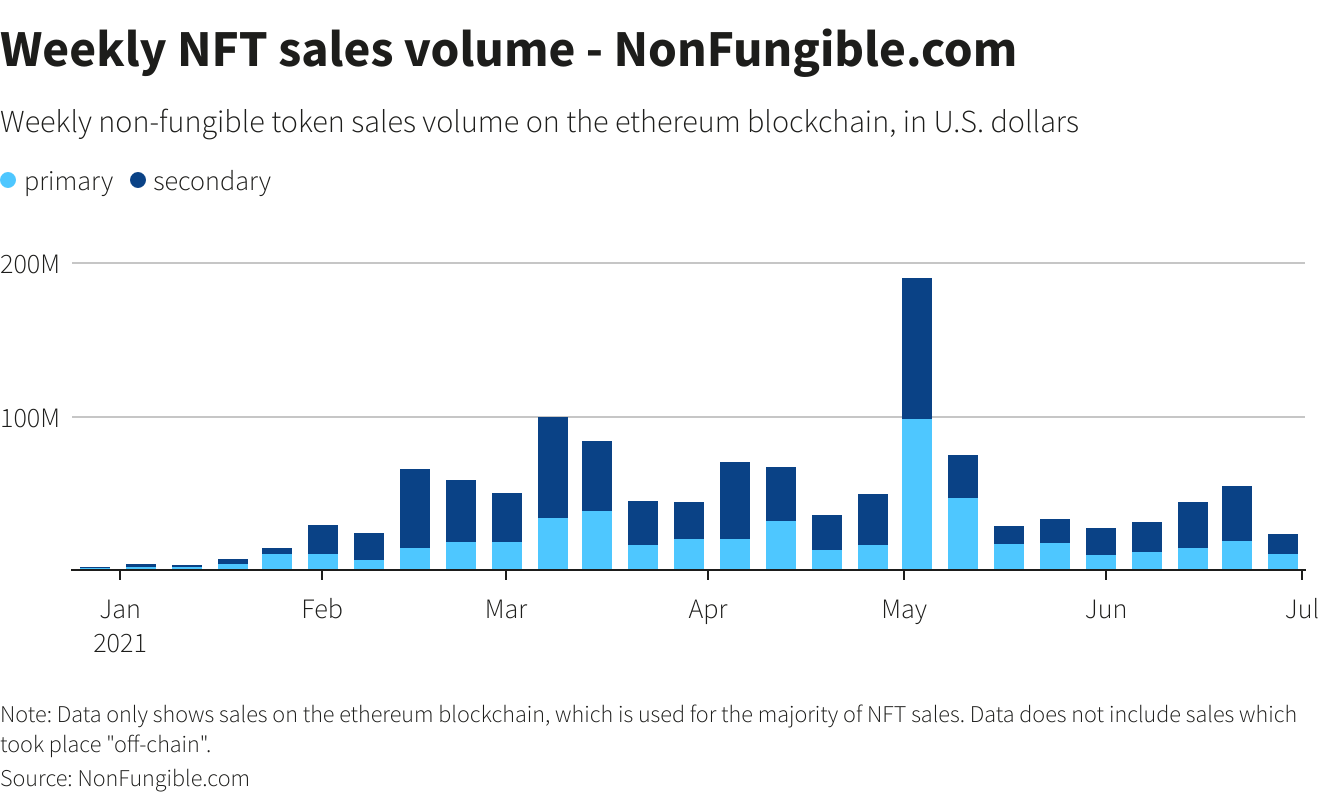

NFT sales volume hits record high in Q2. We haven’t even got to Q3 yet!

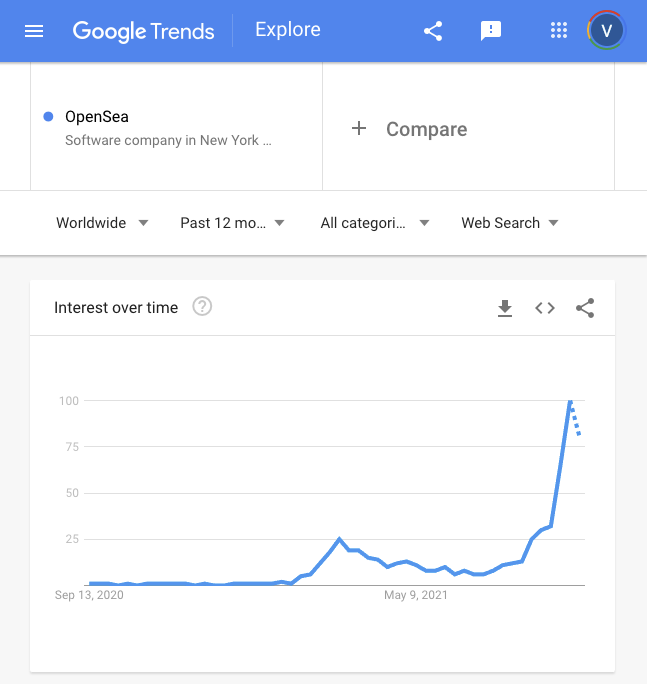

Lastly, you can see with Google search trend, you can see the number of people searching for OpenSea spiking.

I’m been building companies and driving growth for a while. No matter how you slice it, and this is absolutely crazy!

What NFTs allows for the market to do atm is creates a new way to monetise intellectual property.

The present: NFTs, a new way to create status

Where NFT is at today really resonated with me, in a similar way to how brands like Supreme, and Rolex works.

NFT creates status. Digital status.

Some great examples are NFTs like Cryptopunks and Bored Ape Yacht Club, where it allows for digital-native millennials like us, to show off our status symbol in the digital realm.

From my lack of NFT profile pics, you can probably guess, I’m at the bottom of this status game 🤣.

The NFT collection is only valuable if others deemed it valuable.

So right now, what’s driving up the price are essentially people speculating what will be valuable in the future.

Good old supply and demand! Who knew, high school economics does come in handy! Thank you, Ms Muscat, Mr Harrison! 👩🏼🏫 🧑🏼🏫 🙏

Again, we can pull up the data on this, but no surprise here, there are more buyers (demand) than sellers (supply).

However, it’s important to make a distinction here between NFT and other scarce digital assets like Bitcoin. Bitcoin has a limited supply - 21 million. It’s hard programmed in!

In the case of Bitcoin, you cannot create new Bitcoin, the price is purely driven up by demand.

However, with NFT it’s a little different. While the transaction supply is lower than demand atm, the fundamental supply of NFTs is unlimited.

I mean you can literally print the supply of NFTs by programmatically creating a bunch of JPEGs like this 12-year-old kid, who made over $400,000 in one month.

He’s definitely richer than most of the teachers at his school and he isn’t even old enough to have a bank account yet! 😂

Wait, hold on, how can NFT be unlimited when the company tells me there’s only ever going to be 10,000 bored apes? Well, they can always create more…

That’s exactly what happened. Recently, the Bored Ape Yacht Club went and created a spin-off - another 10,000 Mutant Apes. Does this dilute the originals or does that create a new franchise of new property? No one knows…

My cautionary experience with marketplaces which I believe applies to NFT is that: it’s easy to print supply, but it’s a lot harder to create demand.

What did you think about the explosive growth of NFTs? Share this post with friends and start a discussion!

The future: NFT will monetise the world of unique, scarce assets

Look I’m not going to lie to you, the current NFT market does feel very frothy and bubbly to me 🛁.

If you can sell some half scribbled “test” for $270,000 USD… I’m speechless 😶.

It’s very hard to pick a long term winner.

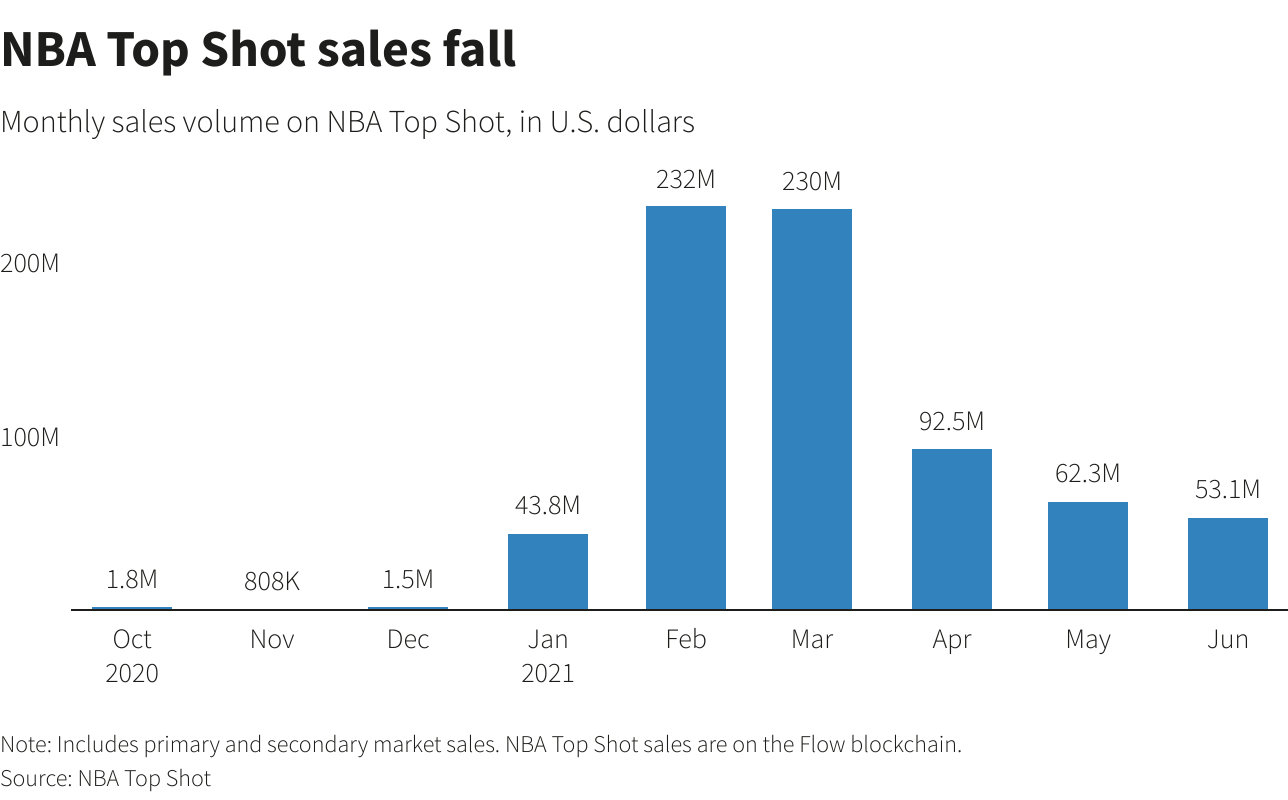

For example, one of the most popular NFT - NBA Top Shot, saw its sales fell by more than 75% in just the last few months. And this is something that’s backed by the NBA with one of the biggest fanbase and sports memorabilia in the history of sports!

Whether NBA top shop wins or loses is not something I spend my time thinking about. I hope the team become successful and everyone wins.

Now I think there are two important distinctions to make about NFTs that many might disagree with me.

It doesn’t matter: what blockchain the NFT is built on;

It doesn’t matter: if the NFT is Decentralised.

Why?

Because people ultimately want IPs that are valuable, regardless of what everyone in the market thinks it’s valuable or not.

Just like art, the value of an NFT is derived from what the next person is willing to pay for it. Not what the majority of people is willing to pay for it.

By extension, it is also a default HODL (hold onto dear life) asset and highly illiquid.

In this kind of new market where assets are highly uncertain, what isn’t uncertain to me, is the application of NFT itself and its future place in the world.

I think it’ll eat up and create completely new markets in the future!

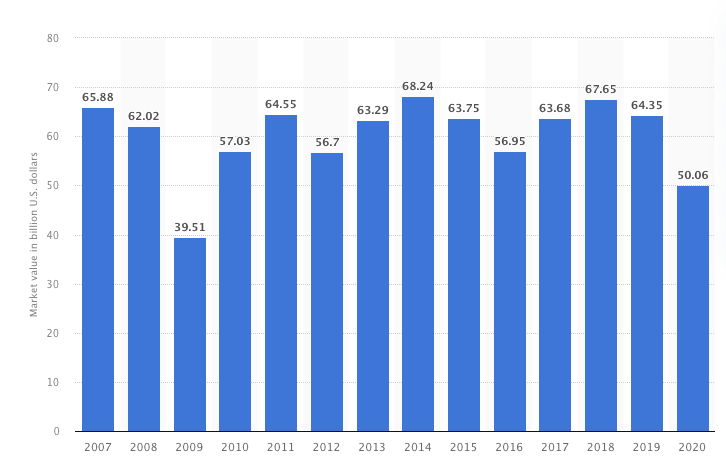

One simple way of thinking about NFT is to look at the $65 billion USD market cap of the global art market today.

However, I don’t think that’ll do NFT justice. It’s so much more.

The Dallas Cowboys Quater Back, Dak Prescott recently launched an interactive NFT on where each week, it’ll change its style base on the gamer’s performance.

This is the equivalent of your grandparent’s autographed baseball changing colours base on whether the team is winning or not. That’s pretty hot 🔥!

This is just the tip of the iceberg. Alethea AI, a startup that’s creating “intelligent” versions of NFTs, is taking this entire idea one step further. They recently announced:

“Alethea seeks to distinguish its NFTs by allowing users to embed AI animation, interaction, and voice synthesis capabilities into the digital art — enabling people to even converse with NFTs.”

Wait, what?! That’s next-level!

Does this remind anyone of the movie, Her, where the guy has an AI computer girlfriend?

What about hosting an app that only people with the NFT can access, to play and win valuable real-world prices?

What about real estate contracts in NFT where the developer can take a 10% cut on every future transaction sale, in exchange to forever maintain and upgrade the property in peak conditions?

What about having limited NFT tickets that give you access to hang out with all future Disney / Marvel movie casts?

Disney, that’s a free idea, you’re welcome. If you do launch it, please give me priority access. I would pay 😆.

If you don’t want to miss out on these future innovations, subscribe and let me keep you up to date!

That’s a wrap!

Well, that’s all from me on NFT this week.

Now if you’re too busy like me and don’t have all the time to do the research on individual NFTs, it makes a lot of sense to invest in the underlying infrastructure itself to participate in the upside.

As you can see in the data I shared, it’s hard to pick a winning NFT project long term, but throughout the boom cycle, Ethereum and Opensea profit the most!

Age all principle applies, the platform always accrues the most value. Don’t pick the individual Youtubers on Youtube or products on Amazon. Just bet on the platform as a whole, and you’ll come out pretty well 😉.

My current approach and thoughts, keep it simple, think long term and bet on the infrastructure itself.

It saves me valuable time to work with the amazing humans at VEED.IO, go boxing, ride my Onewheel and have a bit more calm in my mind. My life can be hectic as it is!

Remember, not investment advice. Always do your own research and “Tread your own path!”

If you’ve learnt something about NFT from me this week, please share it with your friends! It means the world to me!

Cheers!

Vin

How do I invest in Opensea haha

ok ill ape into lazylions, you've convinced me.