Hi friends,

POW POW 🥊 !

Welcome back to the fourth edition of the NewWealth newsletter where every Tuesday, I share my best learnings on business, finance, Bitcoin, and other cryptocurrencies.

Why New Wealth? Because going through school, I realise how little does it really set us up for success. This is the business and life education my friends and I wish we had when we were younger!

Wealth can mean very different things for everyone. For me, health, love, free time is the ultimate measure of wealth. It’s the new wealth that isn’t talked about, and while you don’t need to have a lot of money to achieve those, having money helps makes it a lot easier. It buys you freedom!

If you feel like these values resonate with you, share this newsletter with friends and family, subscribe if you haven’t already.

🎉 A special welcome to the 10+ new subscribers that’s joined us in the last week. 🎉

Shouting out a few of you: Ant, Robert, Jamie, Alejandro and others. Thank you. Great to have you all!

The journey of building a life enriched with your deepest values is always made more beautiful when you learn and work on it together with close friends and family. It also means the world to me to connect and hear from more of you 😊.

Let’s support each other and create a new form of wealth together!

Today, we’re going to cover:

Bitcoin stock-to-flow model (S2F)

Bitcoin to $100M by 2035 by Fidelity

Making a probabilistic bet on Bitcoin

Let’s goooo! 💥

Alright, alright, alright 💪.

As you guys know, I’ve been buying into BTC over the last few weeks. Today, let me share one of the thesis on why.

It’s going to be a very exciting week. If I can convince at least one of you to learn, educate yourself and join me and many others on the Bitcoin journey, this would have been all worth it.

If you have joined us, please email me, tweet me. Welcome!

Now, strap in. Enjoy the show! 😉

Satoshi Nakamoto published the bitcoin white paper on Oct 31, 2008, created the bitcoin genesis block on Jan 3, 2009, and released the bitcoin code on Jan 8, 2009. So begins a journey that leads to almost the $1T bitcoin (BTC) market today.

Bitcoin is the first scarce digital object the world has ever seen. It is scarce like silver and gold and can be sent over the internet, radio, satellite etc.

"As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong [..], not useful for any practical or ornamental purpose .. and one special, magical property: can be transported over a communications channel" — Nakamoto [2]

Surely this digital scarcity has value. But how much? 💭

Scarcity and stock-to-flow

Bitcoin, like gold, and silver is scarce. That’s one way to calculate its value.

When you look up the dictionary definition of scarcity, Oxford Languages defines it as something in “short supply; shortage”.

Another more useful definition of scarcity is: “unforgeable costliness”.

"What do antiques, time, and gold have in common? They are costly, due either to their original cost or the improbability of their history, and it is difficult to spoof this costliness.[..]

Precious metals and collectibles have an unforgeable scarcity due to the costliness of their creation. This once provided money the value of which was largely independent of any trusted third party. - Nick Szabo

Bitcoin has unforgeable costliness because it costs a lot of electricity to produce new bitcoins. Producing bitcoins cannot be easily faked.

Note that this is different for fiat money and also for altcoins that have no supply cap, have no proof-of-work (PoW), have low hash rate, or have a small group of people or companies that can easily influence supply etc.

One popular way to model scarcity is through the stock-to-flow model. This is something the legacy financial world have been using to model the price of rare metals for decades.

This was first applied to Bitcoin by PlanB in 2019 when the BTC market cap was $70bn… and we thought that was high…

Now that’s a lot of mathematics and academics to understand. That’s why I’m here to help. Let me summarise it all for you 👇.

Definition:

S2F = stock / flow

Stock: the size of existing stockpiles or reserves.

Flow: the yearly production.

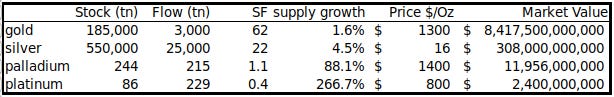

Let’s look at some S2F numbers.

Gold has the highest S2F 62, it takes 62 years of production to get current gold stock. Silver is second with S2F 22. This high S2F makes them monetary goods.

Palladium, platinum and all other commodities have S2F barely higher than 1. This means the existing stock is usually equal to or lower than yearly production.

It is almost impossible for commodities to get a higher S2F, because as soon as somebody hoards them:

→ price rises (decrease in supply)

→ production rises (mining company incentivised to spend more money to mine)

→ flow rise (supply increase back up again)

→ price falls again (assumes demand stays constant)

It is very hard to escape this trap.

Did you learn something? Share this with a friend!

Bitcoin’s economics and S2F

Now one of the beautiful things about Bitcoin is that you can calculate its S2F very easily, that’s because both its stock and flow is programmed in code and completely public! 🔎

Here’s the TLDR:

Bitcoin’s supply is fixed at 21 million. (this is Stock)

Bitcoin generates a new block on average, every 10 mins.

When the Bitcoin miner solves the hash that satisfied the PoW required for the new block, it gets a block reward in the first transaction of each block (a.k.a. coinbase).

The block reward is made up of fees people pay for transactions and newly created coins (called subsidy). (this is Flow)

Subsidy started at 50 bitcoins and is halved every 210,000 blocks (about 4 years) (this is called Bitcoin Halving Cycle).

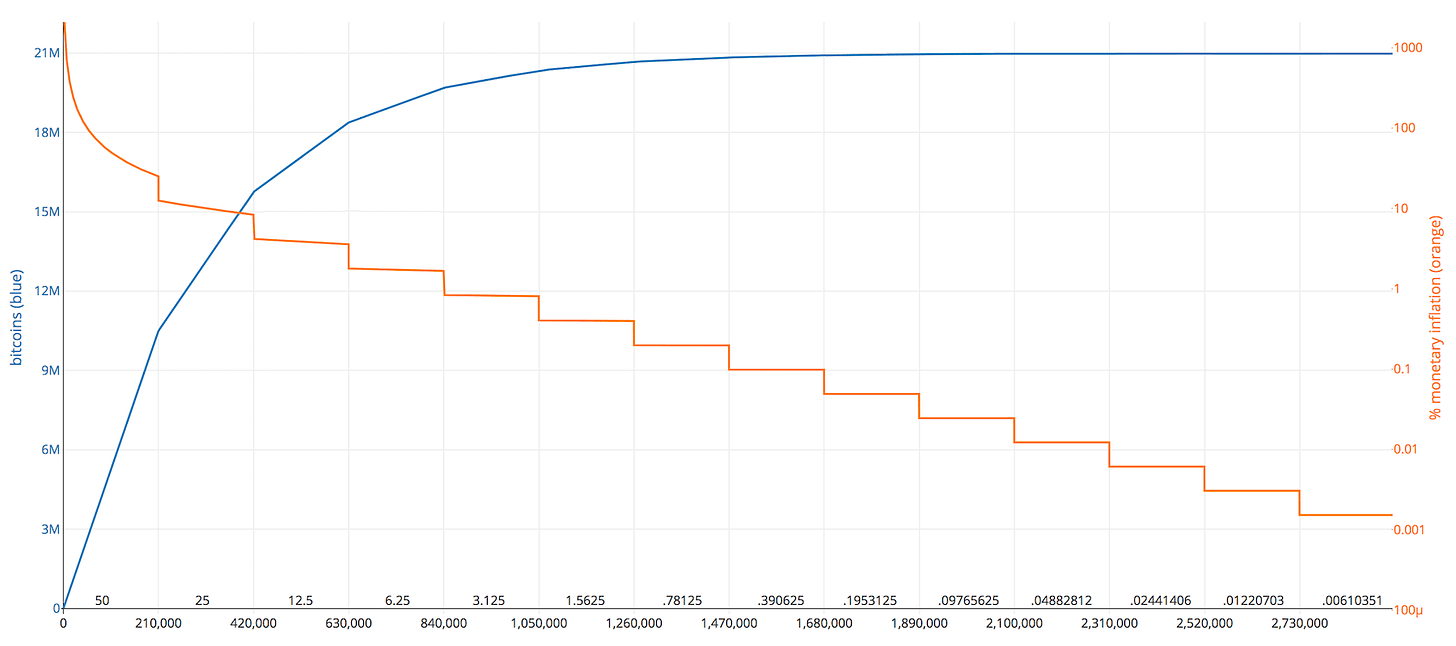

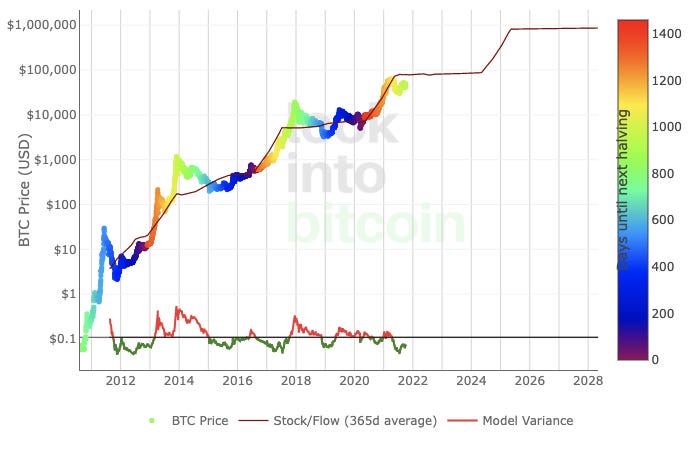

This graph shows you bitcoin’s inflation rate during each having cycle:

It’s like clockwork! 🕰

Note how the blue line (total stock/supply of Bitcoin) approaches asymptotically to 21 million bitcoins, with the gradient (flow) changes with every halving cycle.

This inflation schedule is a gazillion time more transparent and stable than inflation done by the Federal Reserves, and any other government anywhere for that matter…

It’s a superior monetary policy.

Now if we are to overlay Bitcoin price on top of the S2F halving cycle, you can see, it’s a pretty damn good predictor at valuing Bitcoin on scarcity.

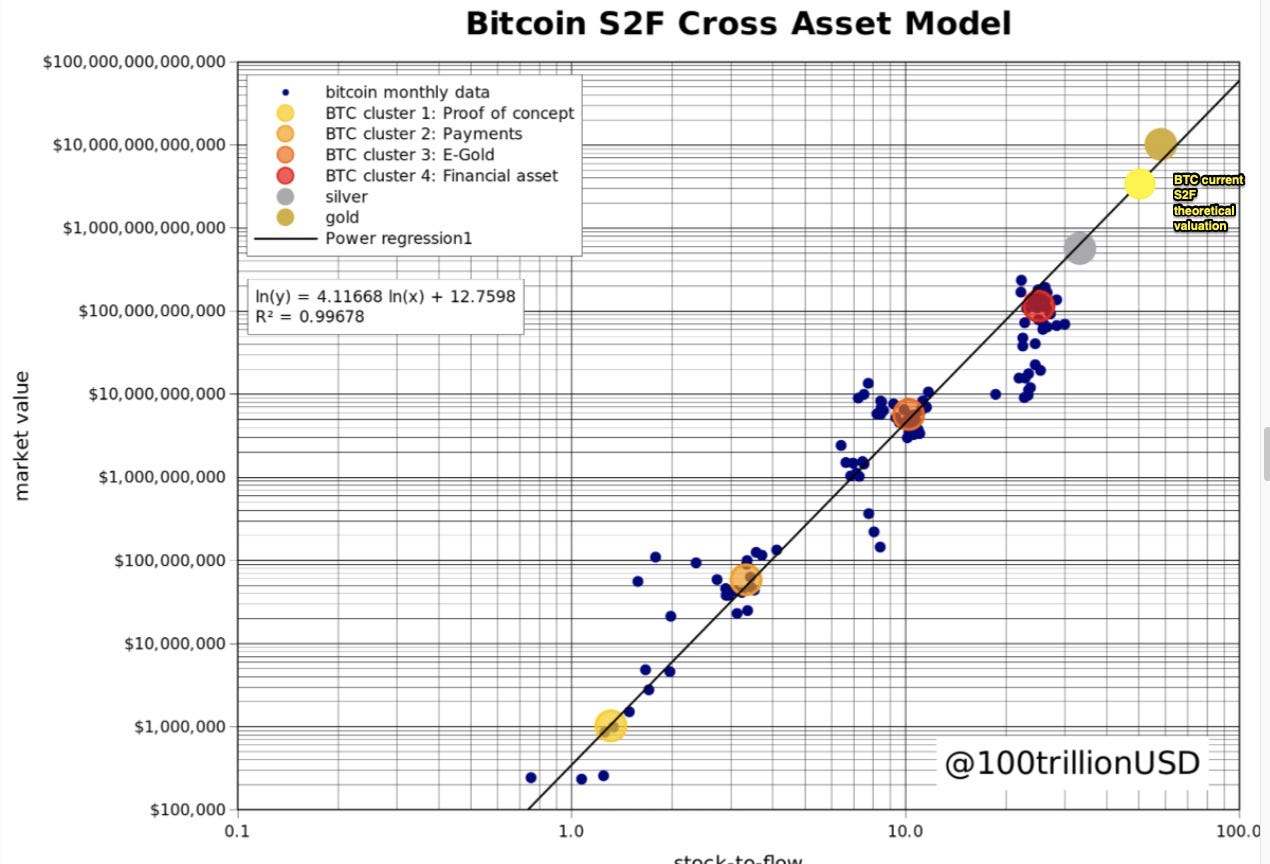

If you’re to plot that along with gold and silver, you’ll see that both gold and silver fits perfectly well into the S2F asset model. S2F is a very accurate predictor of their market cap.

Bitcoin currently has an S2F of around 52.6 at the time of writing this. I’ve taken the liberty of adding that to the same chart above in bright yellow ☝️.

👀 Eyeballing this values BTC at a $3T to $4T market cap. Or in other words: 3 to 4 times higher than where it is today! 🔥

Share this opportunity with a friend!

Fidelity models bitcoin to be $100M by 2035.

Fidelity is one of the largest investment brokerage firms in the world. They have been learning and getting into Bitcoin since 2014.

In 2021, they shared a whitepaper and recently, a webinar by their director of global macro, Jurrien Timmer that models Bitcoin to be at $100M per coin by 2035.

The blue line is the projected price per Bitcoin base on the S2F model done by Fidelity. The black squiggly line is the current price of Bitcoin.

Now, this isn’t someone tweeting on the web to get attention. This is a company with $4.2 Trillion assets under management, presenting opportunities to its customers and investors.

WOW! 🤯

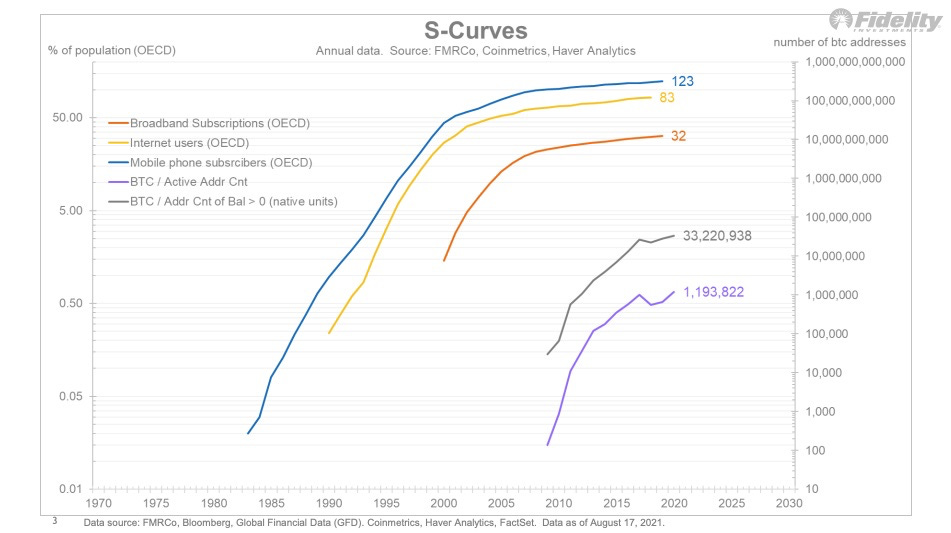

Fidelity also showed another chart that overlaid three things on top of each other:

The black squiggly line is the Bitcoin price

The blue dotted line is Bitcoin’s price base on S2F model

The pink dotted line is the mobile adoption curve - looking at the rate people first adopted mobile phones since the 1970s to approximate the rate people will adopt Bitcoin.

Now when you start to look at this data over the last 10+ years, it’s scary how accurate it is.

The other thing that’s important to call out here is that the mobile adoption curve eventually trails away from the S2F model. Will this affect the price of Bitcoin?

We just don’t know.

But it seems to be pretty accurate all the way, up to $100,000 a Bitcoin. Sounds good to me!

Now an age all quote I love from my time working in data:

All models are wrong. Some are useful.

I think the same applies here. Therefore it’s important for us to question the model and try to create more accurate forecasting of the value of Bitcoin.

For example, we can make an argument that the adoption of Bitcoin will be much faster in mobile because Bitcoin and crypto are built on top of the internet which is also built on top of the mobile. Crypto will get to spread much faster as it gets to enjoy the path carved out by its incumbents.

The below shows a logarithmic comparison of the adoption of Bitcoin with the adoption of mobile phones, the internet, and broadband.

We can see that the adoption rate of Bitcoin is very similar to that of mobile phones and much faster (the curve is steeper) than that of the internet and broadband.

Very interesting!

Making a probabilistic bet

When you think about most things, the price is driven by supply and demand.

Supply is usually not known in “not-scarce” assets. For example, when you buy a company’s stocks, the company at any point in time can always decide to issue more stocks or sell more stocks. This changes the supply and demand of the price per share.

It sucks when the company suddenly decide to load more shares into the market because I know it makes the stock I hold less valuable… 👎

As we move to assets that are more scarce, like gold. We do not know with certainty what is the supply, but we do know pretty well how much gold there is currently and roughly the rate at which gold is mined around the world.

That’s why S2F becomes such a good predictor of price for gold and silver.

With Bitcoin, S2F becomes lethal. When you look at Bitcoin’s supply and demand equation, Bitcoin’s supply is known with 100% certainty into the future. 👍 🥰

I can prove to you with certainty on a public ledger.

Because the supply is certain, to understand the price of Bitcoin, we now only have to focus on understanding demand.

If this model turns out to be correct 10 years down the road, it’ll be in hindsight, one of the most important charts in the history of finance.

Again, I want to reiterate.

All models are wrong. Some are useful.

I think there is a good chance that the S2F model will eventually break in the future because the price of Bitcoin can’t go to infinity.

I am a believer that there’s a 100% we’ll see $100,000 Bitcoin in the next 3 months.

I am a believer that there’s a 50% chance we’ll see $1,000,000 Bitcoin by 2026.

I am a believer that there’s a 10% chance we’ll see $10,000,000 Bitcoin by 2030 (surpasses the market cap of gold + bonds + some equity by cannibalising them).

Now…

If there’s a 1% chance that Fidelity’s $100M Bitcoin price prediction is right, and you can buy Bitcoin today at $50,000. Would you take that bet? 🚀

At 1% chance, that still makes it at least $1M a Bitcoin. With inflation rampaging, stock and property prices at an all-time high…

I know I would.

And already have.

That’s a wrap!

Well, that’s it from me this week. Let me know what you think in the comments below! Love to hear from you!

I’ve got tons of more amazing content coming. Subscribe if you haven’t already.

Did you like the content today? Share it with friends. It means a lot to me and the journey to financial freedom is always more fun when shared with friends!

Remember, none of what I say are financial advice. Everyone’s context and financial situations are different. Always do your own research.

Again, if this had prompted you to buy more Bitcoin, please email me, tweet me. Welcome!

With Bitcoin hitting $1M a coin, I would not care if I bought it for $30,000 or $50,000 today.

Tread your own path!

Cheers,

Vincent

Great post, and great work on the blog Vinny!