Uh oh… How do I Invest in 2023?

Hey friends, company builders, investors,

Bang Bagn! 🧨 💥

Happy Chinese New Year! 🐰 🧧

The most common question I get this year from all of you over the last few weeks, without a doubt, has been how the heck do I invest in 2023; and for company builders, should I be offensive or defensive in building my company in 2023?

I’m here to shed light on this today.

Finance is the language of business. One of the best ways to stay sharp in building your business and building your personal bank account is to study from great investors and operators who’s done it before. Today, I’ll take you back in history to learn some timeless first principles from a business, investment legend and personal teacher of mine: Peter Lynch.

To those of you who are newly subscribed this year: Yegor, Akon, and others, welcome 👋!

Let’s dig in!

Who is Peter Lynch?

Peter Lynch is a renowned investor, fund manager, and author. He is renowned for his management of the Fidelity Magellan Fund (1977-1990) which achieved 29% returns per year. He is considered one of the most successful money managers in history.

If I put it into ChatGPT and simplify it:

He knows how to make money grow and was the boss of a big bank for grown-ups.

You get the point…

Now because exponential growth is really hard for our mind to understand, a better way to put it is, If you had $1,000 invested in Peter Lynch’s fund at the start of his tenure, at the end of the 22 years, you’ll have $362,000. Yes, he is that good 🤯.

In that period of time, he even outperformed Warren Buffet!

Why Peter Lynch and why 1977-1990?

The reason why Peter Lynch is really relevant today (even though most of you may not have heard of him) is not just because he outperforms Warren Buffet. It’s because the economic climate between 1977 - 1990 was very similar to what we are in today.

There was really high inflation due to undisciplined money printing like today. The consumer price index (CPI) started in 1977 at 6.5% and grew as high as 13.5% by 1980!

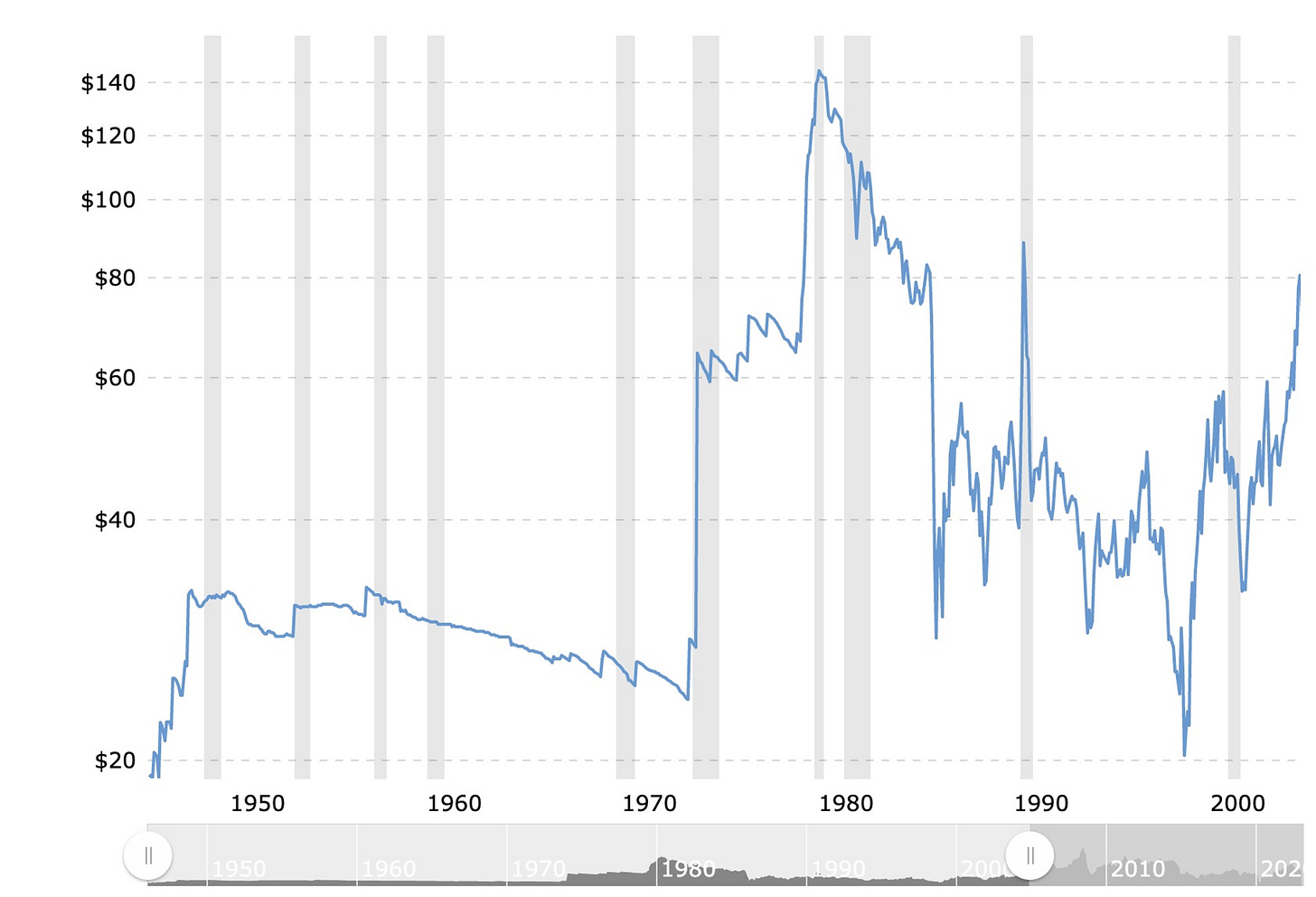

The oil prices also surged greatly then like they did today. By about 6x from $23 to $134 per barrel - much higher than today!

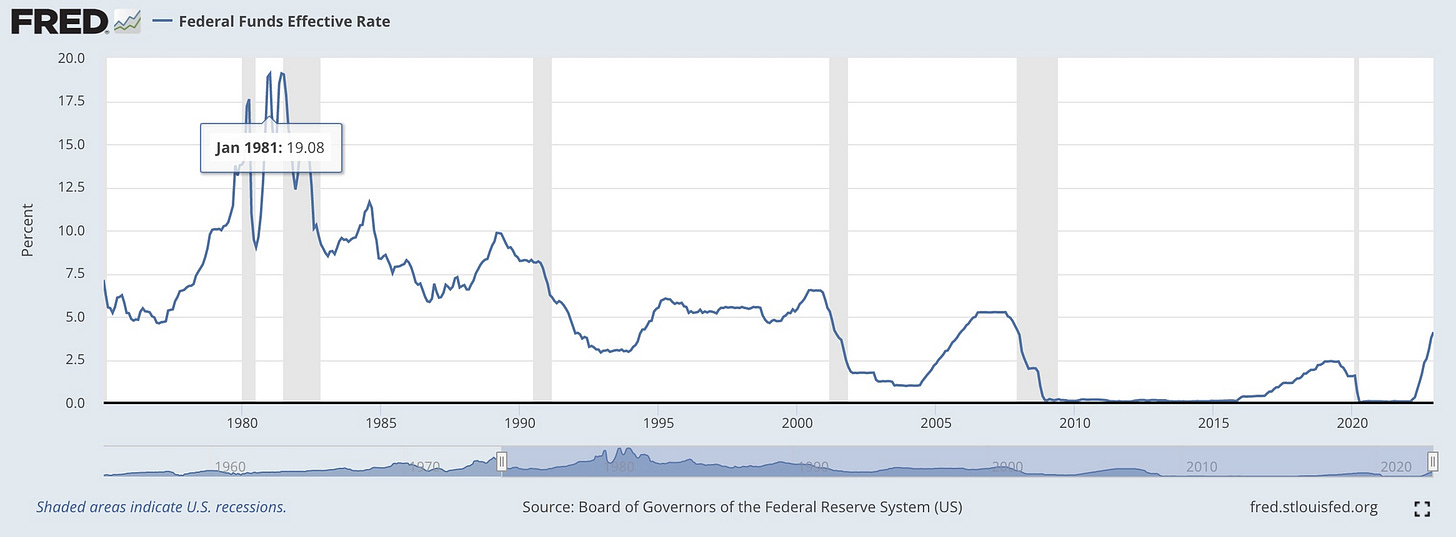

The interest rate rosed famously from 5.4% to 20%! The FED chair at the time, Paul Volcker, hope that it would curb inflation. Compare to the 4.25% interest rate we are in now, what happened then made what is happening now looks like Teddy bear.

The rapid raise of rates led to a severe market crash and created…

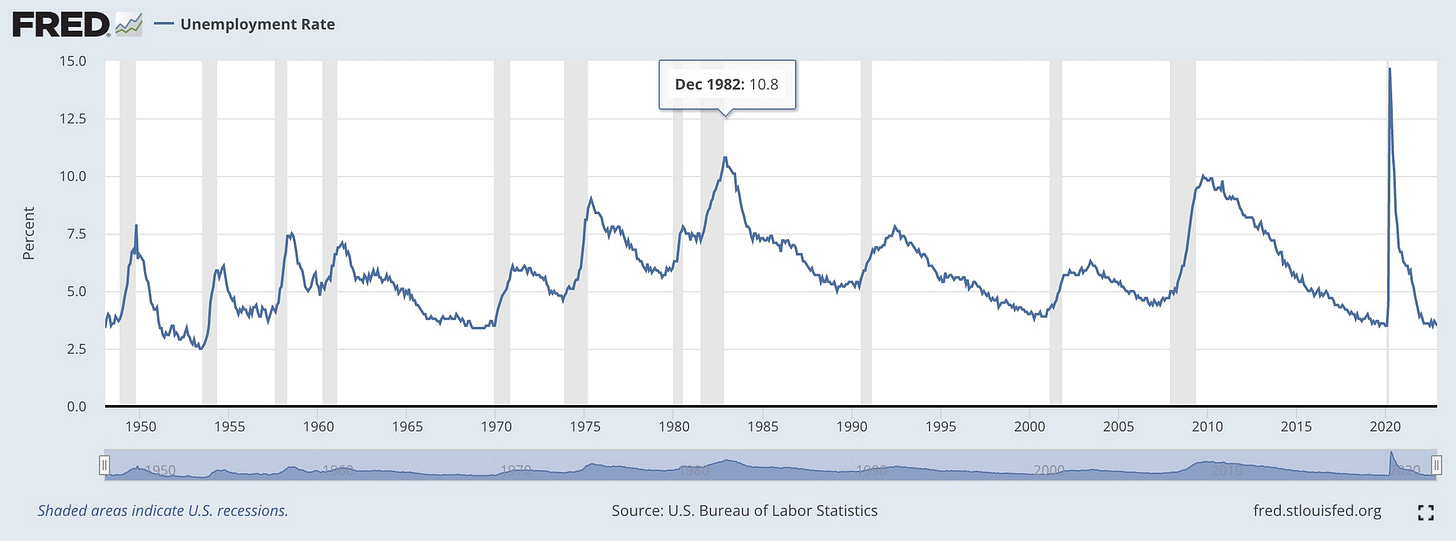

A historically high unemployment rate of more than 10%… That is higher than the 2008 housing financial crisis!

In summary, Lynch has been through one financial hell-fire and came out victorious.

All the issues he’s gone through look like what we’re going to go through in 2023.

Lynch is a very private businessman, so I’ve dug deep, gone back and collected some of his old interview clips, as well as re-reading his book “One Up on Wall Street” to take out some highlighted first principles for you here today.

Focus on great products

Lynch’s investment philosophy is simple. Invest in great products and companies building great products. The way he discovers great products is also really simple: what he loves to use in his life, what his wife loves to use and what people around him love to use and pay for.

I don’t think people understand there is a 100% correlation between with what happens to a company’s earnings over several years and what happens to the stock. If the company (i.e. Mcdonalds) has done very well as a company, the stock has done very well.

What product do you love to use in your everyday life that you’d be really disappointed if you can no longer use?

For company builders, what do you need to do to improve your product such that if your customer can no longer access it, they’d be extremely disappointed?

Focus on that!

Don’t predict what’s going to happen next

People worry about “too much money supply”, “whats the price of oil”, “who’s the president”, “who’s nominated for the surpreme court”, “the Ozone layer”… it’s got nothing to do with anything. If Mcdonald’s earning goes up the next year, the stock will go up.

Sure they can impact the market and they are important, but no one can predict what’s going to happen next.

If Alan Greenspan, who’s the head of Federal Reserve, cannot predict what long term interest rate is going to be 1 year from now, how am I suppose to predict the interest rate and the economy?

Stocks are not lottery tickets

If you’ve spent 14 mintues learning economics, you’ve wasted 12 minutes.

Imagine if you owned Amazon in 1999. You would have seen the stock price drop from over $5 a share to $0.50. If you bailed on your portfolio trying to predict the market going down, you would have lost a lot of money and missed out on one of the greatest financial returns of all time.

In summary, yes the macro is important. Yes, it can impact many businesses. But as an investor and company builder, it’s one of those things that it’s short-term and you cannot control. If you cannot predict it, you cannot control it, why should you spend your time thinking about it?

Don’t be this guy…

Know what you own

If you cannot explain to a 10 year old in 2 minutes or less why you own a certain stock/crypto, other than “the sucker is going up”, you should not own it.

People always like to invest in the latest technology, hardware, software, and microchips without a good understanding of what it is and why a “16-bit dual memory architecture” is important. And that’s why people lose money all the time.

Peter Lynch made a big chunk of his money from Dunkin Donuts because he understands it, a.k.a. he likes to eat there, a lot.

I understand [Dunkin Donuts]. When there’s recession I don’t have to worry about what was happening. I can go there and people are still there. I didn’t have to worry about low price Korean imports and I know you all laugh. I made 10 - 15 times my money in Dunkin Donuts.

So the simple takeaway for everyone here is:

If you are an investor, know what you own.

If you are a company builder, do what you know.

Focus on the long term

One of the most common question people asks is: Do I invest to buy at discount or wait and see?

It’s anyone’s guess what the market is going to do in the next 1000 points. However, I know the market is going to go up in the next 6000 points, and than the next 6000. Corporate profits is going to be a lot higher 10 years from now than it is 20 years from now. That’s what you got to rely on.

NOBODY knows what’s going to happen in the next two years.

Let me iterate again, NOBODY.

But directionally, you can say that corporate profits are going to be a lot higher because human innovation will keep happening. Google didn’t exist 30 years ago. Tesla didn’t exist 20 years ago. OpenAI didn’t exist 10 years ago.

Try and invest in things that you can hold forever because the company/crypto (cough* Bitcoin cough*) is going to be here for the long term.

If you’re a company builder, build for things that’ll be here for the long term, whether than be products, distribution channels, teams etc.

Get a good deal

Valuation matters.

If you found a good company with a great, long-term product and vision that you’d like to invest in, but the valuation is high then that’s a bad company to invest in.

If you want to buy a company, and based on a simple discounted cashflow valuation analysis over the next 10 years, it’s valued at $50 a share. If the share price is also $50 a share, that means the company has to execute perfectly in the next decade for you to break even…

Find a great company that’s priced below its value. Buy things at discount.

Thing in bets

With every investment, there is a risk-reward ratio.

Ask yourself, if I’m right, how much am I going to make? And if I’m wrong, how much am I going to lose?

If I’m right, I’m going to double or triple my money. If I’m wrong, I’m going to lose 30% - 40%. That’s a favourable ratio, especially if there’s already discounting in the stock.

I think company builders and investors should all think a bit like VCs. Think in bets. You need to make bets in companies and crypto that if it wins, you’ll more than double or triple, maybe tenfold your money. Most importantly, own them at a good valuation. That will be a key theme in investing and building companies in 2023.

I thought this was the most appropriate gif I can find for this section 😉.

Summary

So in summary for investors, we should only:

Focus on finding and investing in great products you understand and use.

Don’t try and predict the macroeconomics over the next year.

Look for companies that have a discounted valuation and will return multiple times your money if you’re right.

Focus on investing for the long term.

For company builders:

Focus on making your product foundation great and double down on things you understand about your customer and the levers you understand about your product.

Don’t try to change your company operation try to predict what the market is going to do in the next 2 years.

Only in invest in initiatives that’ll return multiple times your revenue otherwise it’s not worth doing.

Focus on building product, distribution and team for the long term.

That’s a wrap

Well, that’s me today. Today’s research took me a fair bit of time. If you’ve got value, please share it with your fellow friends, investors, and builders. Tell them how amazing it is to be a subscriber 😉.

It’ll make my week~

Have a great week. Until next time. Chat soon!

Vin.