Hi friends,

Pow pow 💥

Welcome to the first-ever edition of the NewWealth newsletter where every Tuesday, I share my best learnings on business, finance, Bitcoin, and other cryptocurrencies.

Why New Wealth? Because going through school, I realise how little does it really set us up for success. So let’s jump into it and built a life of wealth together, valuing:

assets that earn while we sleep;

freedom from working the 9-5s;

bring physically and mentally healthy (8+ hours of beauty sleep!);

learning and growing to our fullest potential;

living a life filled with loving and meaningful relationships;

giving back to the world in our most impactful way.

Topics we’re going to cover this week includes:

Inflation rampage continues and how this is affecting your hard-earned savings;

An interesting idea to denominate assets in Bitcoin;

Education on what actually happens when you invest in Chinese companies like Alibaba and the political & regulatory risks involved;

Let’s go!

The inflation rampage continues…

What better topic to start on than a look at inflation continues. Money printing machine goes brrrrrr!

Last Friday, White House more than doubles its inflation forecast, from “2% to 4.8% in the fourth quarter (October - December 2021) as supply chain disruptions further put upward pressure on prices.

Officials see those price pressures quickly abating next year, with the consumer-price index rising 2.5% in the fourth quarter of 2022.”

The administration officials said: “The updated projections are consistent with other independent forecasts including from the Federal Reserve, and reflect the administration’s view that price pressures, while higher than expected earlier this year, are likely to fade over time….

We think this trajectory is very much consistent with the inflation outlook we’ve been discussing pretty much since we got here,”

Time out for a second! TIME OUT!

What is all this talking about? Absolutely nonsense!

I know, reading all of that above gives me the headspins too. That’s why you’re here. Let me break it down for you:

Our dollar’s purchasing power was initially forecast to lose 2% of its value from Oct-Dec 2021, is now looking like it’ll lose almost 5%!

The government is putting the cause on the price increase of shipping mails and goods across the world, due to COVID-19.

The government spokesperson said this is normal, don’t worry about it and that next year, it’ll be better - at 2.5% Q4 2022, which is higher than the 2% forecast for Q4 2022… Even a 4th grader can tell me that losing my money’s value at 2.5% is worse than 2%.

Wow, I feel a little sick and gaslighted…

Let me dig into the data, the facts and share with you what’s really going on - hint hint, it has a lot less to do with supply chain disruptions (a.k.a. your online shopping shipping fees are going up).

Inflation has been a big problem over the last few decades, but especially worse over the last few years.

Coming from the first principle, inflation is an increase in the money supply, while the productivity of our country stays roughly the same, if not a lot less because of COVID-19 lockdowns.

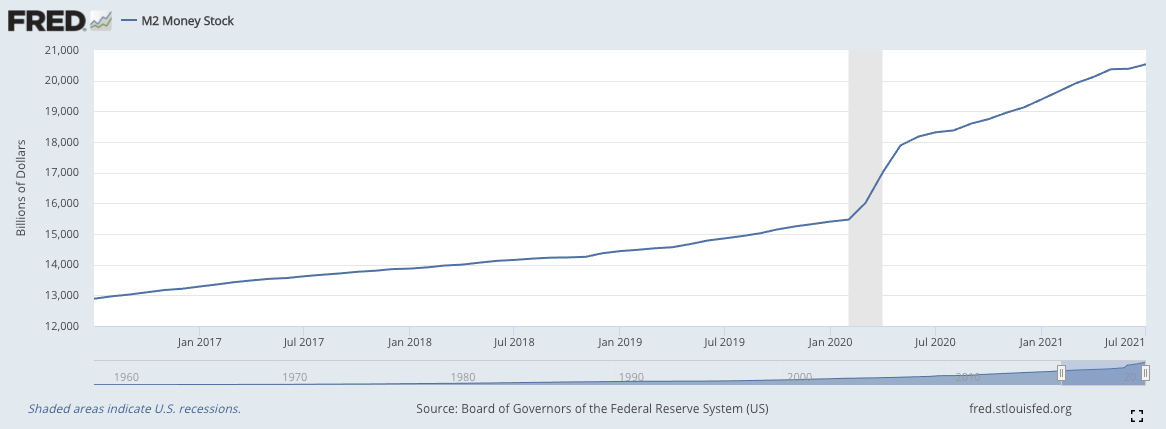

A good way to look at what’s going on is to look up the M2 Money Supply - which is the total amount of cash, checks, and other cash-equivalent going around in a country.

The M2 Money Supply in the US has gone up by 36.7% over the last 24 months from September 2021.

In another word, if you are getting paid $100,000 a year and if you haven’t gotten a pay rise of $37% over the last 2 years, you are technically earning less than you were before!

Inflation is what makes us all have this weird feeling in our stomach that we’re never making enough from our wage, even though we’re saving so hard, and everything around us seems to keep getting more and more expensive!

Now different country manages this differently. I encourage you to Google your country’s M2 money supply and share it in the comments below, share it with your family and friends.

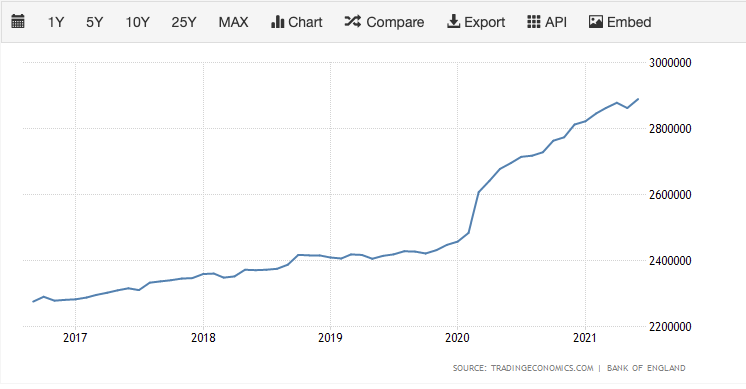

In comparison, UK has only increased their money supply by about 20% over the last 2 years. This is 185% much better than the USA, in another word, if you earn the GBP over USD, just looking at this, you’ve protected more of your money’s value than if you were to make USD.

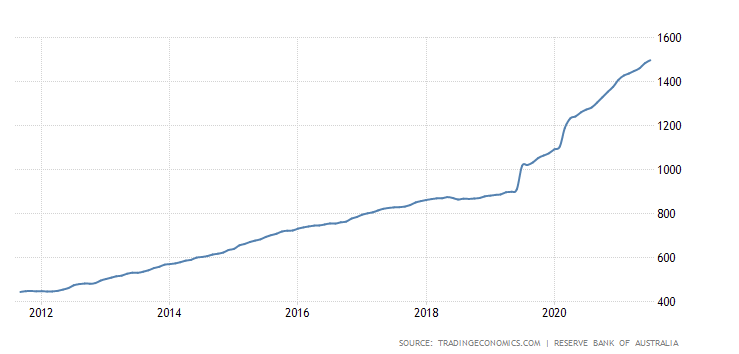

Lastly, let’s take a look at my friends in Australia. With a 36.3% increase in AUD M2 Money Supply, it’s largely inlined with the USD.

However, what makes me feel sad about Australia is that if you increase the timescale to look at how Australia’s been printing money over the last 10 years, compared to USD and GBP, we’ve increased the supply of AUD by 230%!

I don’t know where to find a company that would give me a 230% pay rise… Little surprise here, income is not the way to build the wealth and financial free we’re all looking for. More on this in the future.

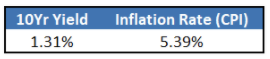

The last thing to look at on inflation is to compare the long term (say 10 years) US bond yield to the inflation rate.

What do these numbers mean? The 10-year bond yield is the interest the government will pay you for lending your money, in a 10-year long term deposit, to the government.

If we’re to plot this over the last 10 years, this is what it looks like:

What does it mean? To keep the math simple, it means if you are to lend the US government $10,000 for 10 years, you'd be losing about $500 every year for the next 10 years. In another word, you'd have only about $6,000 left... Would you take that deal? I would sure hope not!

Now if you are to say let me hold onto my money and save for something, say a deposit for a house, 10 years later, your $10,000 will be eroded down to $4,500... This should turn off anyone who wants to really hold onto the dollar at all. I know I sure wouldn't, over the long run.

A consequence of this high level of inflation is that it pushes people to take on more risks, including people who don’t have a lot of savings and can’t afford to have so much volatility in their financial life.

Devaluing money encourages the formation of asset bubbles.

While the US, UK, AUS’s governments have all tried their best at supporting their citizens through large fiscal stimulus payments, it does back itself into a corner because the supply of goods and services in an economy cannot rise at the same rate that they can print money.

We can debate the various trade-offs of how much stimulus support is useful, but it does come with long term costs, in addition to its benefits. With inflation high, debt high and interest rate low, the real assets (stocks, real estate, commodities, cryptocurrencies) benefits from the outcome.

Because typically in a country, the top 10% have more real assets than the bottom 90%, the rich keep getting richer while the poor struggle and the policymakers are backed into a corner and can only keep printing…

Looking at the data here together today, you probably are feeling scared now. WTF should we do now?

More than ever before we need to be educated, smart with how we manage our money, assets, wealth, and start to create passive income streams that earn while we sleep.

I have tons of ideas and things I’ve done that I’ll share in the future. Subscribe to be a part of the journey!

By not investing in your wealth and only saving, you are losing the value of your hard earned money every year!

Also, wealth building is a positive sum game and always more rewarding when doing it with your friends. Share my newsletter with your friends, partners, families so they can all share in this journey together with you!

What happens if we denominate assets in Bitcoin?

Here’s an interesting thought: as far as we’ve been alive, every asset we’ve ever known or had, has always been denominated in dollars.

We invest in dollars, we get paid in dollars, we pay our taxes in dollars, we buy a house in dollars and we save in dollars. We live in a single currency world. Even if you move from country to country, the same framework holds.

The problem with that, as we’ve learnt from inflation above is that the dollar does not hold a stable value. Over 37% of all dollars today has entered the market in the last 18 months. When the dollar depreciates in value, the asset prices go up.

Investors in Wall Street think they are really smart and they are winning because everything they buy is going up and to the right. Is it?

Well, what if we denominate the S&P500 in Bitcoin?

Here’s a great example:

Note, the y axis is on a logarithmic scale. If you look at the actual number, it’s even worse! Bitcoin is eating the S&P500.

When you denominate all assets in dollars: stocks, real estate, commodities, cars, the dream home you want to buy, everything is going up…

This is because our dollars are being devalued at a rapid rate, all across the world. However, when you start to denominate all these assets into digital sound money like Bitcoin, they are all down significantly.

In another word, if you’ve been saving a small % of your monthly income as Bitcoin instead of dollars over the last 10 years, you’re a lot more likely to have been able to buy your dream home, set yourself up for financial freedom.

Bitcoin is the single best protection of your wealth you have in the last 10 years.

Now I know denominating your assets in Bitcoin sounds a little hardcore for a lot of people, but I think we’re all becoming more and more digital native. I think subconsciously, for people who invest in cryptocurrencies like Bitcoin, we already subconscious denominate assets in Bitcoin - through thinking about the opportunity cost.

I recently had the opportunity to invest in pre-IPO companies at a heavily discounted pre IPO price, as well as startups. The company has made some great progress, solving very interesting problems and the founders were amazing. However, I can’t help but think in the back of my head - if I invest in them, I can’t hold as much Bitcoin and will the value of the company goes up compare to Bitcoin? I’m not sure I’d take that bet.

Inspired by the tweet by Muneeb above, and by many of my friends I know that are buying houses, I created: What happens if we denominate real estate prices in Bitcoin.

I’m seeing a pattern - Bitcoin eats the REIT index. While the past doesn’t predict the future, the factor that causes it to happen in the past, all else being equal, will likely keep causing it to happen in the future.

The best time was to start 10 years ago. The next best time is to start today - even if it’s just a little step.

Do your own research. Tread your own path, my friends! 😊

If you got any questions or thoughts on this, comment below. Share your thoughts!

El Salvador BTC rollout!

El Salvador has begun rolling out and installing 200 Bitcoin ATMs across the country which allows its citizens to convert the cryptocurrencies into USD and withdraw it in cash, as part o the government’s plan to make the token legal tender, with zero ATM fees ever!

Their digital wallet is called “Chivo” which is the local slang term for “cool”.

This will be supported by 50 financial branches across the country for withdrawing or depositing money backed by Bitcoin. The law and launch will take effect on September 7th, and everyone will be able to download the government’s Chivo digital wallet, enter their ID number and receive $30 in Bitcoin.

The government has created a $150 million fund to back Bitcoin to U.S. dollar conversions as a part of the nation’s reserve.

The adoption of Bitcoin will save Salvadorans $400 million per year in fees for receiving remittance abroad (prev. mostly from Western Union).

What a boss! Very exciting times ahead. And for those who still think Bitcoin is pure speculation and has no value, $400 million in fees savings sounds like a bucket tone of value to me! While this is a legislative change, I love seeing how the incentive is totally aligned with its citizens - after all, no one likes paying for ATM or remittance fees!

El Salvador has 6.5 million people, where it’s estimated that more than 70% of the population is unbanked. While there are a lot of uncertainties since they are the first country in the world to do this, the incentive for this to succeed is very high.

What the heck are you actually buying when you invest in Chinese companies?

Last Tuesday, the SEC demands all Chinese companies trading in the US better inform investors about political (China) and regulatory (Chinese government regulations) investor risks.

This protects investors from what happened with DIDI, where the Chinese regulators are able to step in, make very rash decisions that have an incredible impact, which crashes the stock prices immediately.

What does this all mean? What does it mean when the news says that Chinese companies actually rely on an ADR called VIE? Were you thinking of investing in Chinese companies like DIDI, Alibaba, Tencent? Here’s a very comprehensive write up.

But you’re not here for that. Let your boy add some value and simplify it for you!

Let’s use Tencent as an example.

Tencent operates in China under a restrictive list. This means if you’re not a Chinese citizen, you are not allowed to invest in the company and Alibaba is not allowed to sell you shares of its company.

In order for Tencent to get past this law, it creates a Cayman Island shell company (with no real business, no office, no employees) through a VIE structure (variable interest entity) and called it Tencent.

For clarity, I’m going to refer to the actual Tencent as “Real Tencent” and the Cayman Island shell company as “Fake Tencent”.

The Fake Tencent than creates ADRs (American depositary receipt), which is just a certificate issued by US depositary bank, representing, usually, one shares of Fake Tencent on the US stock market that allows people to trade it like any other shares.Once Fake Tencent is set up, Real Tencent sets up a web of complex legal agreements that gives Fake Tencent a claim on the profits and control of the assets in Real Tencent. However, the US government can’t really legally enforces this because the real company is in China.

Because the listed name on the public exchange is also called Tencent, this is super confusing for the investors that they are actually buying Fake Tencent…

In the US, all public companies financial numbers can be audited. Further, the auditors have also audited to ensure we have correct, free and open information for the investors. On the other hand the Chinese companies financial numbers cannot be audited and the auditor themselves (Chinese government operators) also refuse to be audited by the US.

Gary Gensler, the SEC chairman has come out and put his foot down. If the auditors of Chinese operating companies don’t open up their book in the next three years, doesn’t matter if it’s Real or Fake Tencent, will no longer be allowed to be listed on the US stock exchange.

Now if you’re more visual, here’s a video from Gary Gensler himself, explaining how while it’s very nice to swim with the turtles at the Cayman Islands, it’s less fun to invest in these shell companies.

In summary, when you invest in a Chinese company in the US exchange:

You are most likely buying a shell company with no real earnings, employees or IPs.

The Chinese government regulators can come in and change the game midway, causing massive crashes in the stock price, as we’ve seen many times recently.

The financial numbers presented by these Chinese companies cannot be verified. They can lie to you as investors and there’s nothing you could do about it.

Lastly here’s Chamath Palihapitiya’s quick view of Alibaba’s VIE structure 😂.

Now, do I think Chinese companies are worthless, absolutely not! But they come with more hidden risks.

What’s the takeaway from this, do your own research, learn about things deeply and invest only within your circle of competency!

That’s a wrap!

Well that’s a wrap from me! Thanks for reading.

If you’ve been inspired, learnt something or have any thoughts, I’d love to hear from you. Comment below, reply to this email or message me on social media:

What are some of your questions?

What were you looking for when you signed up to this newsletter?

What do yo hope to get out of reading this?

Any other feedback? Hows the content, the format? Is it too long?

Keep in touch. We got this!

Cheers,

Vin

Great work Vince, I learned a lot and enjoyed reading it!

Vinnie,

This is brilliant.

These days I find myself unsubscribing from most newsletters as I don't find value in 99.9% of them. But this article is fascinating. Despite being a lengthy read, you made it very digestible and left me wanting to learn more. I too look forward to the next one.

With much gratitude.

Sharon