Is this the start of the crash? Evergrande what? (#3)

Hi friends,

POW POW 🥊 !

Welcome back to the third edition of the NewWealth newsletter where every Tuesday, I share my best learnings on business, finance, Bitcoin, and other cryptocurrencies.

Why New Wealth? Because going through school, I realise how little does it really set us up for success. This is the business and life education my friends and I wish we had when we were younger!

Wealth can mean very different things for everyone. For me, health, love, free time is the ultimate measure of wealth. It’s the new wealth that isn’t talked about, and while you don’t need to have a lot of money to achieve those, having money helps makes it a lot easier. It buys you freedom!

If you feel like these values resonate with you, share this newsletter with friends and family, subscribe if you haven’t already.

🎉 A special welcome to the 20+ new subscribers that’s joined us in the last week. 🎉

Shouting out a few of you: Erika, Alex, Mickey, Jessie, Kieren, The Drac 2000 😉, Brad, Elisa, Nejc, Paul, Sherif, Ari, Jenn, and many more! Thank you. Great to have you all!

The journey of building a life enriched with your deepest values is always made more beautiful when you learn and work on it together with close friends and family. It also means the world to me to connect and hear from more of you 😊.

Let’s support each other and create a new form of wealth together!

Today, we’re going to cover:

Evergrande on the verge of collapse

What causes an economic crash?

What’s going to happen next; what to keep your eye out for?

No one is selling Bitcoin. Here’s proof

Let’s goooo! 💥

Evergrande collapse sends shockwaves through the economy

On September, 21, China’s second-largest real estate development company by sales, Evergrande Group, faces its imminent bankruptcy.

Evergrande’s collapse has a very real likelihood that’ll spread through entire China’s property market and will definitely send a shockwave that’ll impact many parts of the global economy.

This could trigger one of the biggest stock market events of the decade.

US stock index, SPX is down by 4% in one day.

Iron ore price has dropped like an iron (excuse the pun 😛) by more than 50%!

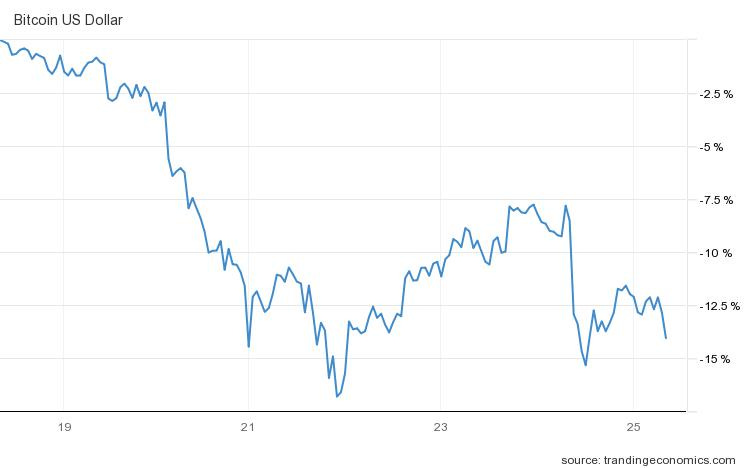

Bitcoin is down by more than 15%…

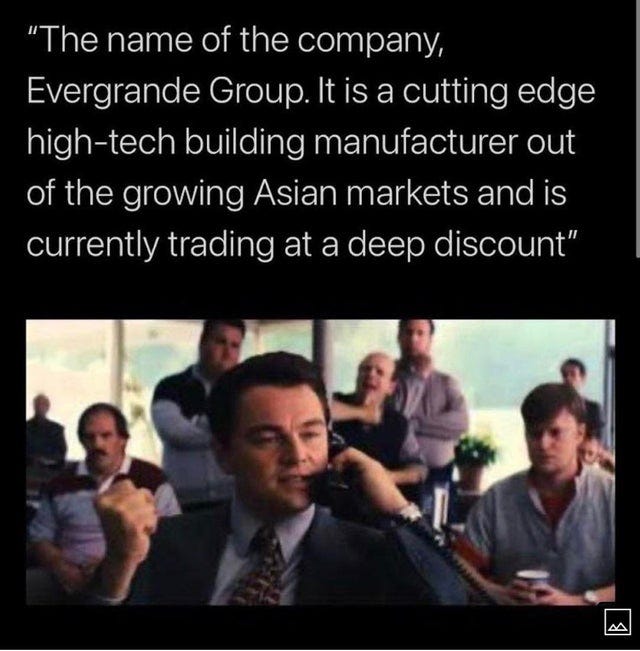

Footage of investors’ accounts on the day can only be best described by this meme I found on Wallstreetbets. At least I haven’t laughed so hard in a while… 😂

To give a sense of how big Evergrande is, it did almost $700 billion Yuan in sales in 2020. That’s approximately $110 billion USD.

To give a sense of how big that is, Evergrande’s revenue is bigger than all of Tesla’s revenue from 2008 ~ 2020 added together… 🤯

The real estate market has been on the rise right? Does that mean they must be making a killing?

Wrong!

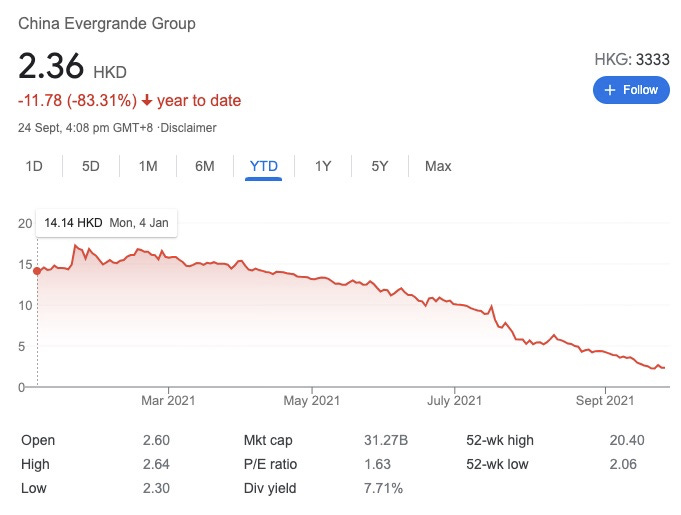

Recently, the investors have become extremely worried about the amount of debt Evergrande has taken on. Year to date, the stock price has crashed down by 83%.

Look at their balance sheet, they have a total liability of $1.9 trillion Yuan ($304 billion USD). This amount to 1.8% of China’s entire economy 🤯.

They own money to 128 banks and 121 non-banking financial companies. On September 15, China’s Ministry of Housing and Urban-Rural Development has told major banks that Evergrande will not be able to make loan interest payments due in a week.

How much do they own?

$83 million of interest on an 8.25%, five-year USD bond (USD bond is just a fancy way of saying a loan taken outside of China is USD)

$232 million Yuan ($36 million USD) on an onshore bond the same day (onshore bond means loan taken inside China).

In total, Evergrande has $660 million in coupon payments coming due through the end of this year. The majority of that is on dollar bonds (loan outside of China, denominated in USD).

Personally, I don’t think they’ll last that long because there’s no clear way how Evergrande will be able to pay back all this debt and it’s very likely that they will default.

In a similar way like Lehman Brothers depicted in The Big Short, Evergrande has borrowed a crap ton of money and now they can’t pay it back…

Usually, people stay the freak away…

But in a world of memes stocks, Wallstreetbets, and DogeCoin, my fellow millennial always asks me, why not BTFD (buy the f*cking dip).

I think the answer is to understand what is fundamentally happening in a crash and does this has a long term impact on the company.

Otherwise, one day you get a call from Jordan Belfour, the tooth fairies, or your gym buddy sharing his bro-science on where’s the next 10 bagger investment is, and you won’t be able to tell the difference!

Don’t worry, this is why you’re here. Let ya boy break it all down for you, so next time you’ll know when to BTFD and when to dodge bullets!

They should really teach this at school…

Oh well, at least you get it for free, by subscribing below if you haven’t already!

What causes an economic crash?

Everything has a beginning has an end NEO.

In the spirit of me being very excited about the new Matrix movie, let’s start from the beginning: how does fiat money work in a credit-based economy?

Concept 1: Our fiat money is inherently worthless; essentially it’s an IOU (I owe you).

Think of money like the bar tab/gift cards on your local bar.

When you have $10 credit, it is inherently worthless. There isn’t $10 worth of gold, silver or Bitcoin that your $10 represent.

What your $10 credit represent is a promise to redeem $10 worth of valuable goods/services (in this case: beers) from the bar.

However, if one day, your local bar is to shut down and no longer become available to you, your credits are essentially worth ZERO. This is because the promise of your credit being able to turn into beer is gone; the promise is broken.

Now instead of us being a member with a bar tab to your local bar, we can apply this concept to anything:

The $10 Lunch money I lend to my friend in the 3rd grade.

The $10,000 I’ve saved up in USD, as a member of the United State of America. OR in this case.

The amount of money investors has lent to Evergrande, with the promise that they’ll pay them back with interest…

Much like the bar tab, the promise to repay a loan is worthless until the debt is settled later on.

Bonds are exactly the same. When you purchase bonds on the stock market, you are essentially buying another company or companies’ promise to repay back their loan with interests on maturity (a set time frame).

That’s why bonds have:

Face Value: the amount paid back to the holder at maturity.

Coupon: the interest payments to a bondholder receives periodically until the bond matures.

Concept 2: There’s about 10x - 20x more credit than there is actual money to pay back at any given point in time in a fiat economy.

According to Ray Dalio, one of the best hedge fund managers in the world, in 2012, there’s about 10x - 20x more credits that can be created, from an underlying loan.

For example, the total amount of credits in the US is about $50 trillion dollars. Whereas the total amount of money that generated this credit is about $3 trillion dollars.

How is this possible?

Well, let’s continue the Evergrande example. When Evergrande borrows money from a lender, the lender doesn’t just hold onto the credit. It often packages it into bonds, along with a basket of other loans and trades it on the public market.

Other companies and investors will traditionally buy these bonds because they are “usually” very stable, pays a higher interest (coupon rate) than what the bank gives you, and act as a good hedge against inflation on a company’s balance sheet.

Because the housing market has been on the rise over the last decade, everyone falsely presumes it’ll continue to go up and keep trading these bonds over and over again, thinking it’s rock solid.

Suddenly, a single loan of millions can be turned into assets worth billions of dollars spread across the economy.

Now, if you are a reader of my first post, We are all in a lot of trouble, you’ll know that bonds being a good hedge against inflation is no longer true and I wouldn’t touch bonds with a 10-foot pole right now. I know you’re the same, which makes you better off than a lot of professional investors already 😉.

Here’s a good video from The Big Short that explains how something similar, like the housing mortgages in 2008, can expand into billions and trillions worth of credits that brought down the global financial system.

Concept 3: A economy comes tumbling down when a big enough debt suddenly cannot be serviced by the debt holder’s income.

In our credit-based, fiat currency economy, because we can leverage a small amount of money into a large amount of credit, our economy is actually built like a house of cards.

If someone cannot fulfil their promise to pay back a loan at the base of this house of cards, the whole economy can come tumbling down.

Evergrande’s property debt is a good example of a type of debt that supports the base of this “house of card” economy.

How come Evergrande suddenly can’t service its debts? How did they end up in this 💩 show?

They’ve over-leveraged themselves.

Traditionally, when you’ve borrowed more money than you can pay off, you would slow down, tighten your belt and start paying back those debts. However, Evergrande did the opposite. They keep borrowing, taking out new debt to pay off old debt.

To borrow more debt, they pre-sell construction buildings that aren’t yet complete and uses some accounting trick to treat the incomplete buildings as assets, that can then be used to take out more loans.

This is why some companies never seem to pay off their debts because they just keep rolling them over. Very naught 🤡 !

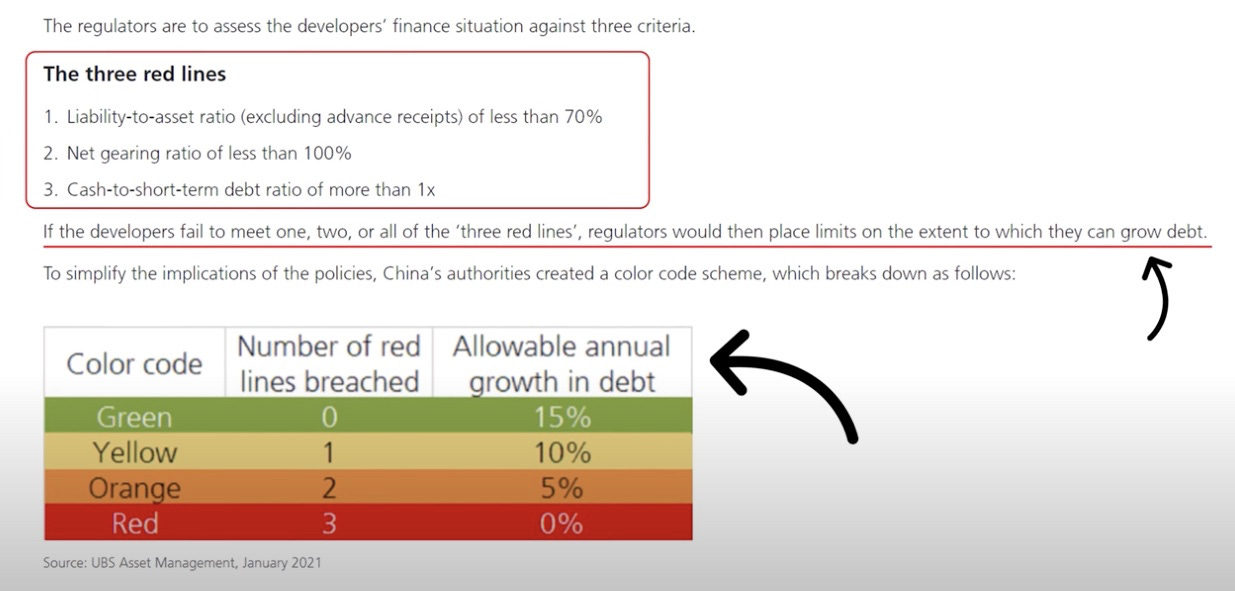

Chinese government new rules that reduce how much debt construction companies can hold.

The Chinese government recently enforced new rules that govern how much debt construction companies can hold, to avoid companies recklessly accumulating too much debt like Evergrande.

This puts a tremendous amount of pressure on Evergrande because they can no longer service their old debt by creating new debt.

In order to reduce its debt over the last year, the company already has been selling off buildings and assets at a discount to the market price.

So now you know, the way to look out for the next economic crash is by looking for situations where income can no longer service debts. Share this with friends and family so they know too!

Evergrande’s options and their consequences

If you’re Evergrande or an educated millennial investor like yourself 😉, what happens from here?

Evergrande simply has one option: find some cash, without taking on new debt and slowly pay off its debt + interests (coupons).

They’ve got 30 days to pay the $83.53 million… And they also got to find $193.3 million over the next several weeks to pay off the upcoming coupons. It’s a ticking time bomb 💣.

Now if I’m the guy appointed to sort out all this mess, where would I start?

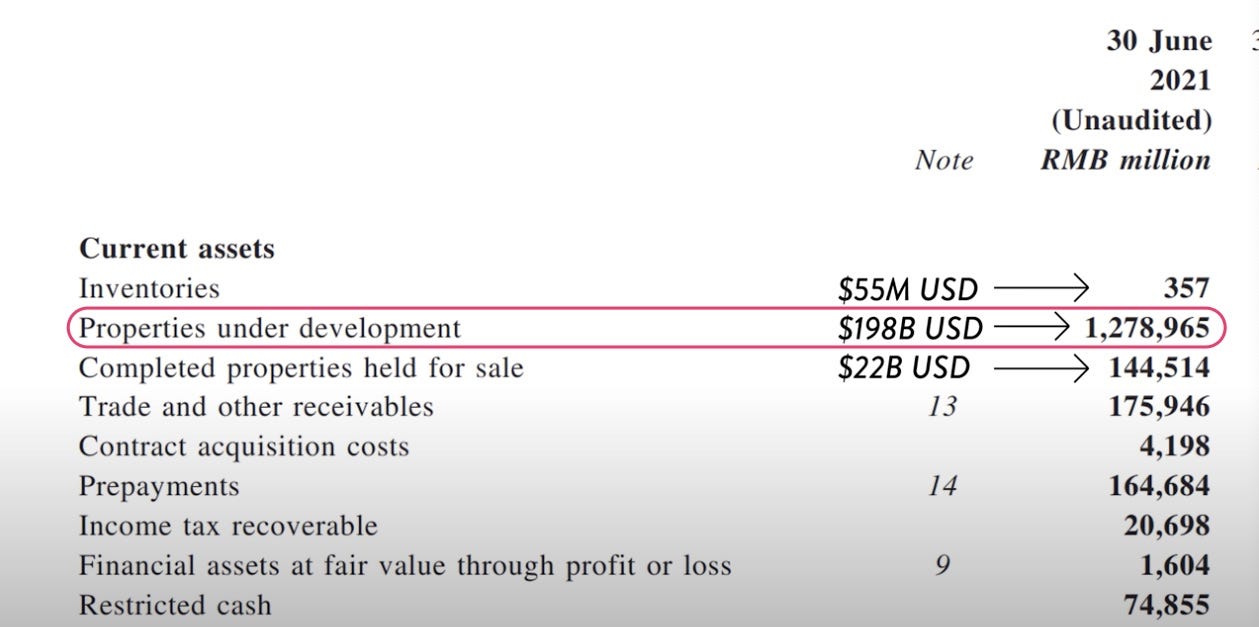

Well, looking at their balance sheet, you can see that majority of their assets sits under “properties under development”.

However, I think these properties are unlikely to deliver value because:

In complete properties aren’t worth anything

With the company in such a tight financial position, it’s unlikely to be able to pay its vendors to finish the construction.

This money is essentially dead in the water.

With its biggest asset being worthless, I now turn my attention to “inventories” and “completed properties held for sale”.

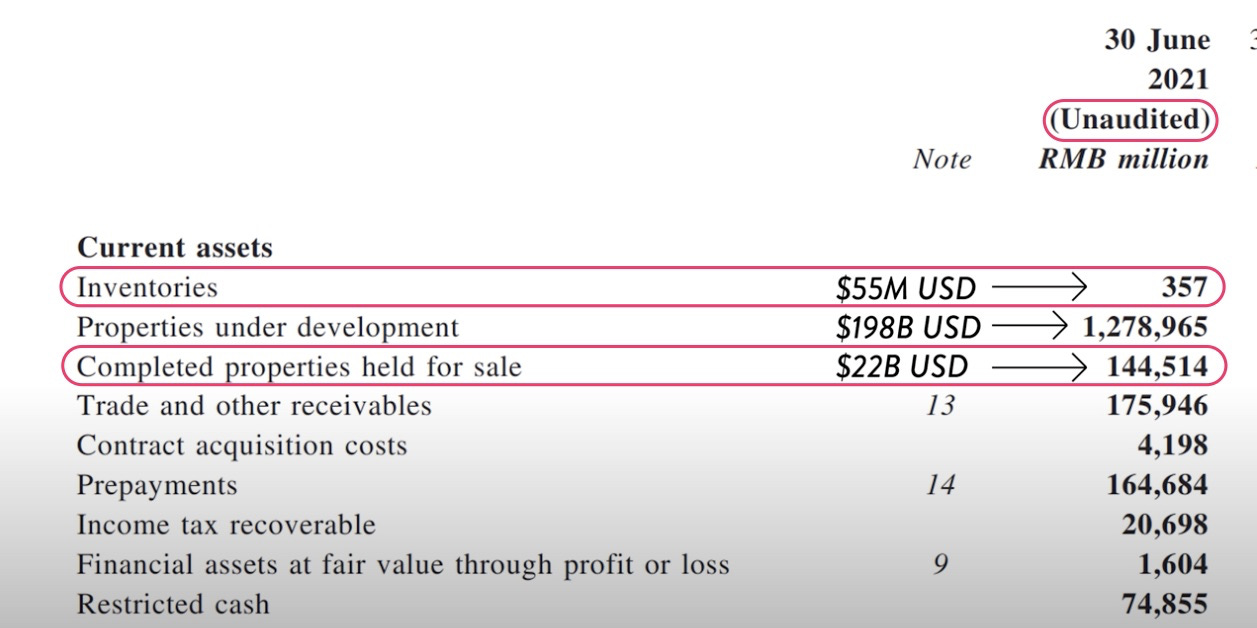

While that doesn’t look too bad on the surface, if you dig deeper, you’ll learn that majority of the “completed properties held for sale” are already used as collateral for their debt…

Now I’m not as educated as I’d like in the field of property, however, while doing my late-night readings, Patrick Boyle’s findings surfaced up, which is a lot of Evergrande’s property are overvalued and not as valuable as it would seem.

This is because the value of what completed buildings are, in their inventory, intrinsically, you could say it’s how much it costs them to build.

Fundamentally, the real value of a completed building is only what the next person is willing to pay for them.

However, the accountant has essentially made up their own estimate on how much these buildings are valued for… and taken a debt out against that. It is also reported that a lot of these properties aren’t built in locations as valued/demanded by the consumer as it costs to build them… (I would encourage you to see more from Patrick Boyle’s work on this if you want to dig deeper).

These are such dodgy accounting practices… No wonder their public balance sheet, like many companies in China, are “unaudited” and cannot be audited by an independent third party due to Chinese government regulation.

If you remember what I shared in my first newsletter on increase in risks in Chinese investments due to government and regulatory risks, here’s another classic example of it.

I would personally stay the hell away! 💚

Don’t BTFD on this one 😉.

What is likely to happen?

There are currently two future outcomes:

Evergrande collapse completely

Government steps in to provide support

At the moment, the Chinese government has expressed that there’s no intention of stepping in to provide support because they do not want to set a precedence to bail out companies whose accumulated debt recklessly.

If Evergrande collapse, what’ll happen first is a fire sale. What this means is it’ll start selling off all its assets/buildings at a really discounted price in order to liquidate quickly and pay off as much debt as it possibly can.

This is really bad as the sudden supply of cheap real estate could bring down the Chinese construction/housing market.

It makes everyone’s assets suddenly worth a lot less, devalues other construction company’s asset value of their balance sheet, which makes it harder for them to take out debt and repay their loan and so on…

It could topple other construction companies like dominos.

Suppliers and contractors who work for Evergrande won’t get paid. This will also cause another ripple effect across the industry as these suppliers and contractors might not be able to pay their debt due to their income (credits from Evergrande) suddenly disappearing.

If supplies and contractors in the construction industry also start to go bankrupt, we can see the entire industry slows down.

Banks could start scrutinising other construction companies and decrease the amount they loan out because the overall economy becomes less creditworthy.

Investors who hold property-related bonds start to panic sell because the bonds are not going to be repaid and their value rapidly goes to zero.

You get the picture…

What exactly is going to happen next, no one really knows. How Evergrande debt is connected with the rest of the market, no one knows.

That’s the opaque legacy financial system for - boooo! 💩

Proof no one is selling Bitcoin

Now, while the legacy financial system isn’t transparent, you know what is? The Bitcoin network!

(Would this be a New Wealth edition without me touching on Bitcoin slightly? 😛)

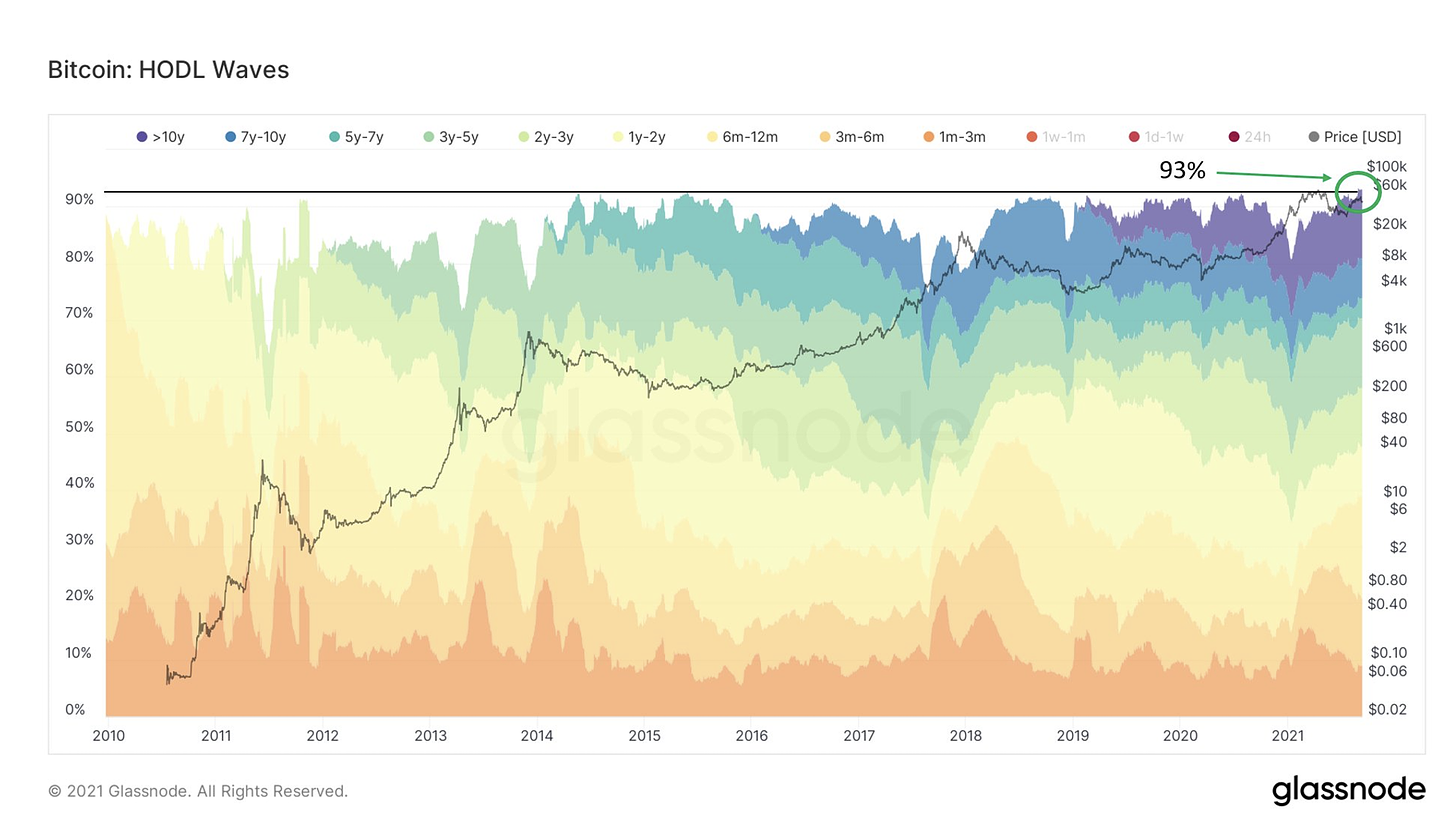

While bitcoin price may have dropped by 22% on the day, we can tell the sell-off from short term investors are being bought by long term investors (source from Bitcoin on-chain analyst: Willy Woo). In fact, 93% of the Bitcoin supply are now bought up and hasn’t moved in at least a month. The amount of supply that’s being actively traded is at an all-time low.

Do you know what that means? When supply decreases, the price eventually goes up 😉 🚀.

Bitcoin is one of the few assets that are, in relative terms, very uncorrelated from the global stock (equity) market.

I’m very bullish and definitely buying 📈. Oppa!

As a wise man once said: Look at what I do, don’t look at what I say. 🔥

Share this data on Bitcoin with our fellow Bitcoin brothers and sisters (even if they don’t know they’re going to become one yet!):

That’s a wrap!

Well, that’s it from me this week. Let me know what you think in the comments below! Love to hear from you!

Sorry for missing a week in between. A lot has been happening in the world of business, finance, Bitcoin and I also got a bit sick for a few days from the COVID vaccine.

I’ve got tons of more amazing content coming. Subscribe if you haven’t already.

Did you like the content today? Share it with friends. It means a lot to me and the journey to financial freedom is always more fun when shared with friends!

Remember, none of what I say are financial advice. Everyone’s context and financial situations are different. Always do your own research.

Tread your own path!

We got this!

Cheers,

Vincent